By Ann Saphir and Howard Schneider

(Reuters) -U.S. Federal Reserve officers bought encouraging knowledge on Friday suggesting inflation is cooling, information that helped ease doubts over how effectively financial coverage is doing its job after stronger-than-expected worth will increase earlier within the yr.

However whereas progress on a month-to-month foundation is more and more clear, the highway to the Fed’s 2% inflation purpose – measured in year-over-year phrases – is prone to be lengthy, complicating discussions about when to chop rates of interest. “We’re getting proof that (coverage) is tight sufficient,” San Francisco Federal Reserve Financial institution President Mary Daly informed CNBC in an interview simply minutes after a Bureau of Financial Evaluation report confirmed inflation didn’t rise in any respect from April to Might. “It is actually difficult to look wherever and never see financial coverage working: we now have progress slowing, spending slowing, the labor market slowing, inflation coming down.”

On the identical time, Friday’s inflation knowledge exhibits there’s nonetheless much more progress wanted. From a yr in the past, the non-public consumption expenditures worth index rose 2.6%. The Fed’s goal is 2%.

The Fed has stored its coverage price within the 5.25%-5.5% vary since final July when it delivered what U.S. central bankers say will probably show to be the final price hike of an aggressive marketing campaign begun in March 2022 to struggle excessive inflation.

The central financial institution has mentioned no price cuts might be applicable till policymakers acquire extra confidence that inflation is on a sustainable path to their 2% purpose.

Merchants on Friday guess that the newest inflation figures will agency up that confidence. Quick-term interest-rate futures are actually pricing in a couple of two-in-three probability that the Fed will ship a primary coverage price reduce in September, with one other one anticipated in December.

“Might’s inflation print was effectively beneath the brink the Fed must be comfy and breaks the string of excessive inflation prints we have seen for the reason that begin of the yr,” wrote Natixis economist Christopher Hodge.

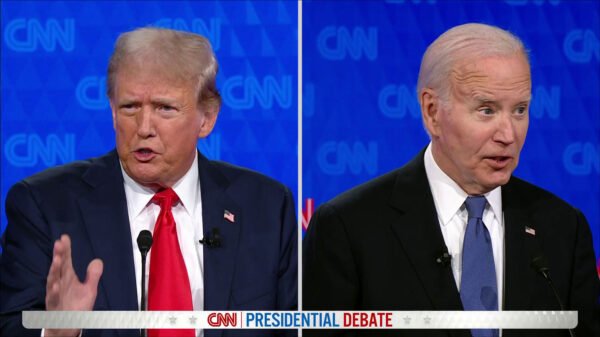

However the optics for price cuts may very well be difficult.

Even when inflation as measured from month to month rises barely in order that, annualized, it’s consistent with the Fed’s 2% goal, the super-low inflation readings within the second-half of final yr imply it might take till the tip of the yr to see progress within the year-over-year readings.

That might power Fed officers right into a tough debate over determine simply when the month-to-month numbers present sufficient sign to gentle the fuse on price cuts and cease referring to inflation as “elevated” of their coverage assertion.

The Fed subsequent meets on July 30-31.

Daly on Friday reiterated that inflation continues to be too excessive, and mentioned she expects year-over-year inflation to probably stay above 2% by way of the tip of 2025. Earlier this week Fed Governor Lisa Cook dinner mentioned she expects inflation to go “sideways” this yr, and fall extra sharply subsequent yr.

Many Fed policymakers have recently stayed away from making clear pronouncements on when they could reduce charges, referring as a substitute to varied situations that might imply a later, or an earlier, resolution.

To date the Fed has stored charges on maintain for longer than a number of earlier episodes.

Atlanta Fed President Raphael Bostic is among the many minority of U.S. central bankers who’ve been keen to place a timeframe on a doable price reduce. “I proceed to consider circumstances will probably name for a reduce within the federal funds price within the fourth quarter of this yr,” he mentioned on Thursday.

PCE inflation peaked in June 2022 at 7.1%.

“The massive image for me is that there was large progress however there’s nonetheless a distance to journey,” Bostic mentioned, and the main points of the inflation knowledge will matter to the Fed’s evaluation of additional progress. “There have been intervals when one or a small variety of objects transfer the headline quantity. I wish to look by way of that and see if there are different dimensions that give us confidence…Even when the topline stays the place it’s.”

One element Bostic and different Fed policymakers have their eye on is the share of products and companies whose costs are growing at 5% or extra. That share has fallen lately.

Fed Governor Michelle Bowman, among the many extra hawkish of U.S. central bankers, stays cautious of lowering borrowing prices this yr. Although central banks in different components of the world have begun to cut back their coverage charges, Bowman mentioned the Fed would observe its personal path.

“We have…actually robust employment and a robust labor market in the meanwhile, however we have not fairly reached our inflation purpose, and we’ll proceed to work towards that on our personal tempo,” she mentioned on Friday.