Revealed: Dec 17, 2024, 07:28 GMT+00:00

Key Factors:

- UK wages rose 5.2% in October, complicating BoE price lower bets amid rising inflation and regular unemployment at 4.3%.

- The BoE faces strain as October wage progress outpaces forecasts, signaling increased inflation dangers into Q1 2025.

- BoE anticipated to carry charges at 4.75% Thursday, with rising wages and inflation clouding early 2025 outlook.

On this article:

Labor Market Overview, UK – December 2024

The newest UK labor market knowledge delivered one other problem for traders betting on a near-term Financial institution of England price lower. October’s figures will seemingly gasoline recent debate on the Financial institution of England’s subsequent transfer.

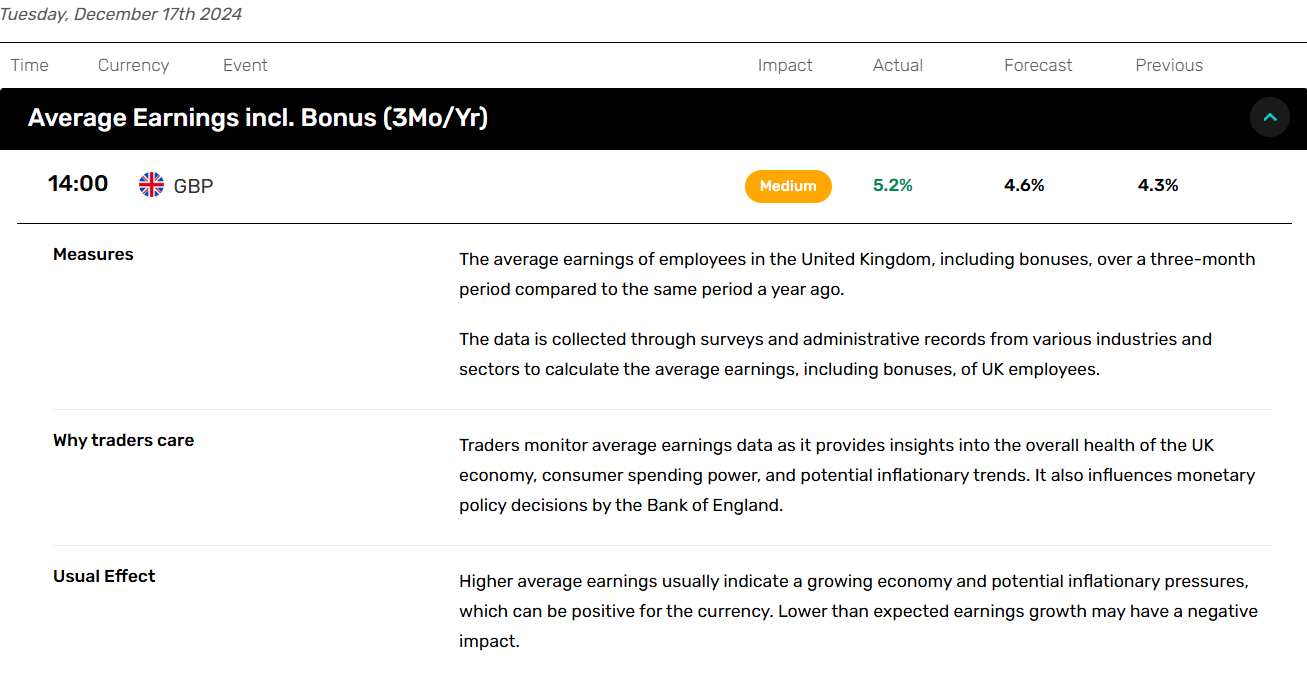

The UK unemployment price held regular at 4.3% in October, suggesting a stabilizing labor market. Nonetheless, common hourly earnings (together with bonuses) rose by 5.2% within the three months to October 2024, in comparison with the identical interval in 2023, up sharply from 4.3% in September.

Knowledge from the Office for National Statistics highlighted a number of key traits:

- The variety of payrolled UK workers grew by 24,000 month-on-month in October however dropped by 22,000 over the three-month interval.

- Job vacancies fell by 31,000 from September 2024 to November 2024, marking the twenty ninth consecutive interval of decline.

- Claimant counts edged up by 300 in November after falling by 10,900 in October.

Might stronger wages sign a BoE coverage maintain via Q1 2025?

October’s rise in common earnings (together with bonuses) helps the BoE’s cautious strategy to chopping rates of interest. Increased wages could gasoline shopper spending and demand-driven inflation. Inflation traits could delay potential BoE price cuts.

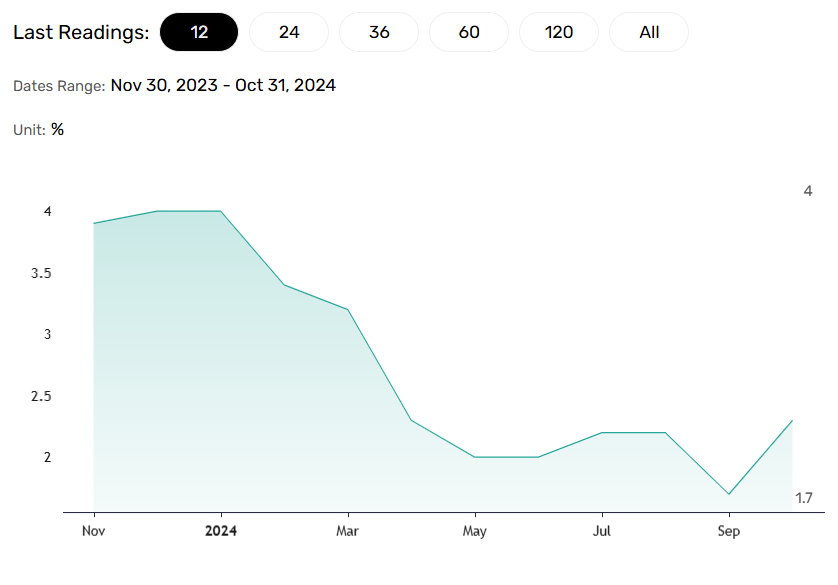

The UK’s annual inflation price jumped from 1.7% in September to 2.3% in October, surpassing the BoE’s 2% goal. Upcoming UK inflation figures, due on Wednesday, could additional dampen expectations for a Q1 2025 BoE price lower. Economists count on an annual inflation price of two.6% in November.

The continued rise in inflation additionally raises issues in regards to the timing of any potential BoE price cuts. Rising wages and better inflation may put the BoE on an much more cautious footing on Thursday when it pronounces its remaining financial coverage determination for the 12 months. Economists extensively count on the BoE to maintain rates of interest unchanged at 4.75%.

Nonetheless, the BoE should additionally contemplate the implications of the UK Finances. Companies have warned about increased wages paired with job cuts, complicating the wage growth-unemployment dynamic as a information for consumption and inflation traits.

What Do Specialists Suppose Concerning the Upcoming BoE Curiosity Fee Resolution?

Chris Williamson, Chief Enterprise Economist at S&P World Market Intelligence, remarked on December’s PMI knowledge, stating,

“Whereas the December PMI is indicative of the financial system kind of stalled within the fourth quarter, the lack of confidence and elevated culling of jobs hints at worse to come back as we head into the brand new 12 months.”

Williamson concluded,

“Policymakers on the Financial institution of England could also be cautious about chopping rates of interest, nevertheless, given the resurgence of inflation being signaled, including additional to downturn dangers in 2025.”

GBP/USD Response to the UK Labor Market Knowledge

Forward of the October UK labor market report, the GBP/USD briefly climbed to a excessive of $1.26981 earlier than falling to a pre-report low of $1.26656.

After the discharge of the UK Labor Market Overview Report, the GBP/USD surged from $1.26707 to a excessive of $1.26947, reflecting the influence of wage progress on financial coverage.

On Tuesday, December 17, the GBP/USD was up 0.07% to $1.26905.

Concerning the Writer

With over 20 years of expertise within the finance business, Bob has been managing regional groups throughout Europe and Asia and specializing in analytics throughout each company and monetary establishments. At the moment he’s masking developments regarding the monetary markets, together with currencies, commodities, different asset courses, and world equities.

Newest information and evaluation

Commercial