BANGKOK — Shares retreated in Asia on Thursday after a lackluster end on Wall Road following a report exhibiting an uptick final month in inflation within the U.S.

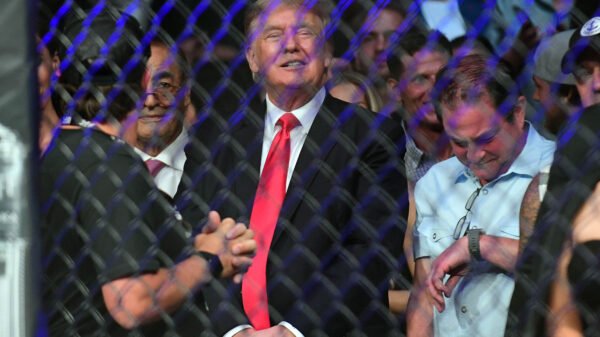

The greenback was buying and selling close to 156 Japanese yen, up from 155.49 yen, reflecting expectations that the greenback will achieve in opposition to different currencies underneath the insurance policies anticipated with the incoming administration of President-elect Donald Trump.

Japan’s Nikkei 225 index fell 0.4% to 38,535.70 and the Kospi in South Korea gave up 0.1% to 2,415.23. Australia’s S&P/ASX 200 gained 0.4% to eight,224.00.

Chinese language markets tumbled, with the Cling Seng in Hong Kong falling 2% to 19,435.95. The Shanghai Composite index misplaced 1.7% to three,379.84.

Bangkok’s SET misplaced 0.2% and Taiwan’s Taiex fell 0.6%, whereas the Sensex in India shed 0.2%.

A stronger greenback tends to place pressure on different economies, famous Stephen Innes of Capital Economics. The Thai baht has additionally weakened in opposition to the greenback because the U.S. election, as has the Chinese language yuan, or renminbi, which now stands at 7.2245 per greenback and was buying and selling at about 7 yuan per greenback in early October.

“For Asia, notably these economies intently linked to China, the greenback’s dominance is poised to change into an financial wrecking ball,” he stated in a commentary. “International locations with hefty USD-denominated debt are bracing for influence,” he added.

On Wednesday, U.S. shares drifted to a combined end after the latest inflation update boosted hopes {that a} minimize to rates of interest subsequent month will convey extra assist for the economic system.

The S&P 500 was practically unchanged, gaining 1.39 factors to five,985.38, up lower than 0.1%. It was its first loss since a giant rally erupted after the Nov. 5 Election Day. The Dow Jones Industrial Common added 0.1% to 43,958.19, and the Nasdaq composite slipped 0.3% to 19,230.74.

U.S. client inflation accelerated in October to 2.6% from 2.4%, however an underlying measure known as “core inflation” didn’t rise. Such core inflation generally is a higher predictor of future developments, economists say, so the figures added to expectations for extra assist from the Federal Reserve.

The Fed started slicing rates of interest from their two-decade excessive in September to maintain the job market hummin g after bringing inflation nearly all the way down to its goal of two%. It minimize once more earlier this month, and merchants now see an improved chance of roughly 80% for a 3rd minimize at its assembly subsequent month, in line with knowledge from CME Group.

These expectations despatched the yield for the two-year Treasury right down to 4.27% from 4.34% late Tuesday. The yield on the 10-year Treasury, which additionally takes future financial progress extra under consideration, rose to 4.45%, up from 4.43% late Tuesday.

However T rump’s victory within the presidential election has raised uncertainty over the Fed’s future course. Economists say his preferences for lower tax rates, greater tariffs and fewer regulation may in the end result in higher U.S. government debt and inflation, but in addition convey quicker financial progress.

Whereas decrease rates of interest can make stronger the economic system and to costs for investments, they’ll additionally gas inflation.

Rivian Automotive jumped 13.7% after the electric-vehicle firm gave extra particulars a few three way partnership it’s getting into with Volkswagen Group that they had previously announced. The deal’s whole measurement might be price as much as $5.8 billion, which is greater than the $5 billion the businesses had beforehand stated.

Spirit Airways’ inventory misplaced 59.3% after it said in a regulatory filing that it’s attempting to work out a deal to renegotiate the compensation of its debt that may wipe out the corporate’s stockholders, however may shield workers and prospects.

Within the crypto market, bitcoin was tracing at $89,990 after crossing above $93,000 as cryptocurrencies typically soared. Trump has embraced cryptocurrencies, pledging to make the U.S. the crypto capital of the world.

Dogecoin, a cryptocurrency that’s been a favourite of Tesla’s Elon Musk, additionally gave up a few of its achieve from earlier within the day. Trump named Musk as one of many heads of a “Department of Government Efficiency,” or DOGE for brief.

In different dealings early Thursday, U.S. benchmark crude oil shed 43 cents to $68.00 per barrel in digital buying and selling on the New York Mercantile Trade. Brent crude, the worldwide customary, gave up 39 cents to $71.89 per barrel.

The euro fell to $1.0545 from $1.0587.