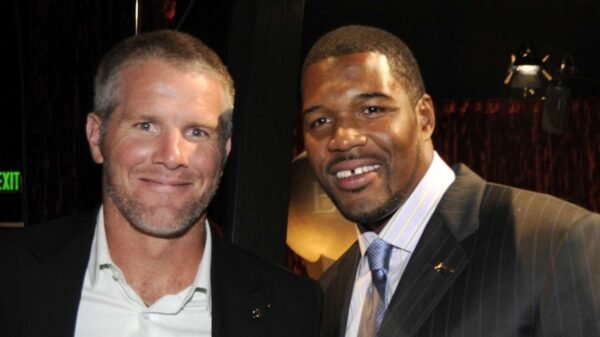

Lee Jin-man

A foreign money dealer stands close to the display exhibiting the Korea Composite Inventory Value Index (KOSPI) at a international change dealing room in Seoul, South Korea, Thursday, Dec. 12, 2024. (AP Photograph/Lee Jin-man)

BANGKOK (AP) — Shares had been largely greater Thursday in Asia after Wall Avenue resumed its upward climb, as an replace on inflation appeared to clear the way in which for extra assist for the financial system from the Federal Reserve.

Chinese language shares rose as leaders met in Beijing to set financial plans and targets for the approaching 12 months. The federal government introduced plans to increase trial non-public pension packages to your entire nation, starting Dec. 15.

The Grasp Seng in Hong Kong jumped 1.4% to twenty,441.57 and the Shanghai Composite index gained 0.9% to three,461.50.

Tokyo’s Nikkei 225 index superior 1.2% to 39,849.14, led by shopping for of expertise shares. Advantest Corp., which makes gear for testing pc chips, gained 5.1%, whereas chip maker Tokyo Electron was up 0.6%.

South Korea’s Kospi gained 1.6% to 2,482.12, whereas the S&P/ASX 200 in Australia slipped 0.3% to eight,330.30.

Taiwan’s Taiex climbed 0.6% and the Sensex in India shed 0.2%. The SET in Bangkok picked up 0.2%. The S&P 500 rose 0.8% to interrupt its first two-day losing streak in almost a month and completed at 6,084.19. Massive Tech shares helped drive the Nasdaq composite up 1.8% to twenty,034.89. It was its first shut above 20,000. The Dow Jones Industrial Common, in the meantime, dipped 0.2% to 44,148.56.

Inflation within the U.S. ticked as much as 2.7% in November from a 12 months earlier from 2.6% in October, fueled by pricier used vehicles, resort rooms and groceries. That exhibits some worth pressures stay elevated, however not sufficient to forestall the Fed from reducing rates of interest at its assembly subsequent week.

The Fed started trimming rates in September from a two-decade excessive to assist a slowing job market after getting inflation almost all the way in which all the way down to its 2% goal. Decrease charges would improve the financial system and to costs for investments, however they might additionally present extra gasoline for inflation.

Expectations for a sequence of cuts to charges by the Fed have been one of many primary causes the S&P 500 has set an all-time high 57 times this year, with the newest coming final week.

Tesla jumped 5.9% to complete above $420 at $424.77. It’s a stage that Elon Musk made well-known in a 2018 tweet when he mentioned he had secured funding to take Tesla non-public at $420 per share.

Sew Repair soared 44.3% after the corporate that sends garments to your door reported a smaller loss for the newest quarter than analysts anticipated. It additionally gave monetary forecasts for the present quarter that had been higher than anticipated, together with for income.

GE Vernova rallied 5% for one of many largest features within the S&P 500. The vitality firm that spun out of Normal Electrical mentioned it will pay a 25 cent dividend each three months, and it accepted a plan to ship as much as one other $6 billion to its shareholders by shopping for again its personal inventory.

Albertsons fell 1.5% after submitting a lawsuit towards Kroger, saying it didn’t do sufficient for his or her proposed $24.6 billion merger settlement to win regulatory clearance. A day earlier, judges in separate cases in Oregon and Washington had nixed the grocery store giants’ merger. The grocers contended a mix might have helped them compete with huge retailers like Walmart, Costco and Amazon, however critics mentioned it will damage competitors. Macy’s slipped 0.8% after reducing a few of its monetary forecasts for the complete 12 months of 2024, together with for a way a lot revenue it expects to make off every $1 of income.

In different dealings early Thursday, U.S. benchmark crude oil picked up 13 cents to $70.42 per barrel in digital buying and selling on the New York Mercantile Alternate. Brent crude oil, the worldwide commonplace, gained 23 cents to $73.75 per barrel.

The U.S. greenback slipped to 152.35 Japanese yen from 152.46 yen. The euro rose to $1.0527 from $1.0496.

Copyright 2024 The Associated Press. All rights reserved. This materials will not be printed, broadcast, rewritten or redistributed.

Pictures You Ought to See – Sept. 2024

Be part of the Dialog

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-600x337.jpg)

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-100x100.jpg)