![]()

contributor

Posted:

Share this text

- Raydium confirmed a collection of bullish indicators within the 4-hour time-frame chart.

- RAY’s inflows have been constructive within the final 24 hours, suggesting a slight return of bulls.

Raydium [RAY] was buying and selling at $5.57, as of press time, which was a 23% improve prior to now 24 hours, in line with CoinMarketCap. The amount additionally surged by 94% which was $356M.

RAY has escalated greater than 190% from the preliminary breakout level recognized earlier within the pattern, suggesting it could be repeating the sample.

Within the H4 timeframe, RAY confirmed a collection of bullish indicators, notably the breakout from a bullish pennant sample. This implies a possible continuation of the uptrend.

The formation of a bullish pennant, with the worth consolidating after a pointy rise adopted by an upward breakout, indicated robust shopping for strain.

The resistance ranges to look at, primarily based on current value motion, are close to $6.40 and $7.60. These align with projected will increase of about 35% to 50% from the breakout level.

These metrics level out…

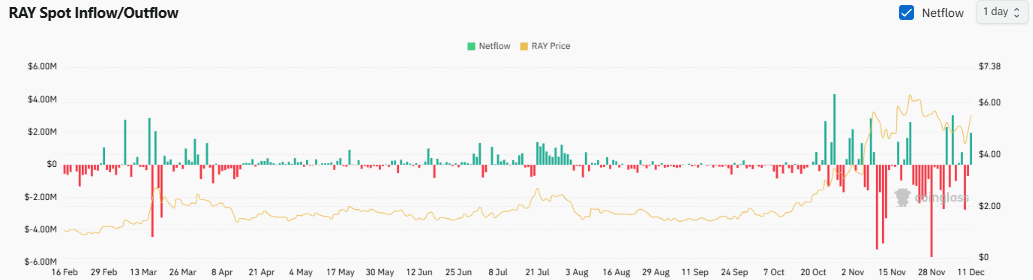

RAY’s Spot Influx/Outflow has proven substantial variation, with vital spikes in influx particularly seen in current weeks. These inflows corresponded to cost fluctuations in RAY.

The peaks in web influx recommended renewed shopping for curiosity, doubtlessly indicating a bullish sentiment amongst merchants.

Influx spikes do assist the potential 35% improve, however additionally they convey potential volatility, as evidenced by the fast rebounds to outflow.

A sustained improve in shopping for strain is a robust indicator of potential rally continuation, regardless of the OI-Weighted Funding Price being -0.0319%. This implies quick merchants are paying lengthy merchants.

Within the final 24 hours, the constructive web influx suggests a slight bullish return. Nevertheless, cautious commentary of continued tendencies in influx and outflow is important to substantiate any long-term value actions.

RAY’s DEX Quantity

After trailing Uniswap for a lot of the 12 months, Raydium surpassed Uniswap in October with a DEX quantity of $90.5 billion in comparison with Uniswap’s $45.3 billion.

In November, RAY achieved a outstanding $124.6 billion, greater than doubling Uniswap’s $51.1 billion. This helps the anticipated 35% surge, though it’s topic to alter.

Learn Raydium [RAY] Price Prediction 2024-2025

This surge in Raydium’s quantity, pushed considerably by memecoins which constituted 65% of its November transactions, indicated its current dominance.

The “Pump Enjoyable” occasion notably contributed over $100 million in month-to-month charges to Raydium, indicating robust monetary efficiency and consumer engagement throughout the platform.

Share

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-600x337.jpg)

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-100x100.jpg)