Home » Bitcoin » MicroStrategy’s Bitcoin holdings yield over $10B in beneficial properties as BTC tops $80K

MicroStrategy’s strategic funding technique below Michael Saylor sees vital progress amid bullish market circumstances.

Key Takeaways

- MicroStrategy’s Bitcoin holdings have generated over $10 billion in unrealized beneficial properties.

- Bitcoin’s worth enhance to $80,000 coincided with Trump’s reelection and international financial changes.

Share this text

MicroStrategy’s Bitcoin holdings have surged to over $20 billion in worth, producing greater than $10 billion in unrealized beneficial properties as Bitcoin’s worth topped $80,000 right this moment, in line with data tracked by its portfolio.

The corporate, headed by Bitcoin advocate Michael Saylor, has gathered 252,220 Bitcoin since its preliminary buy in 2020, with a median acquisition value of round $39,200 per Bitcoin, translating to a complete funding value of round $9.9 billion.

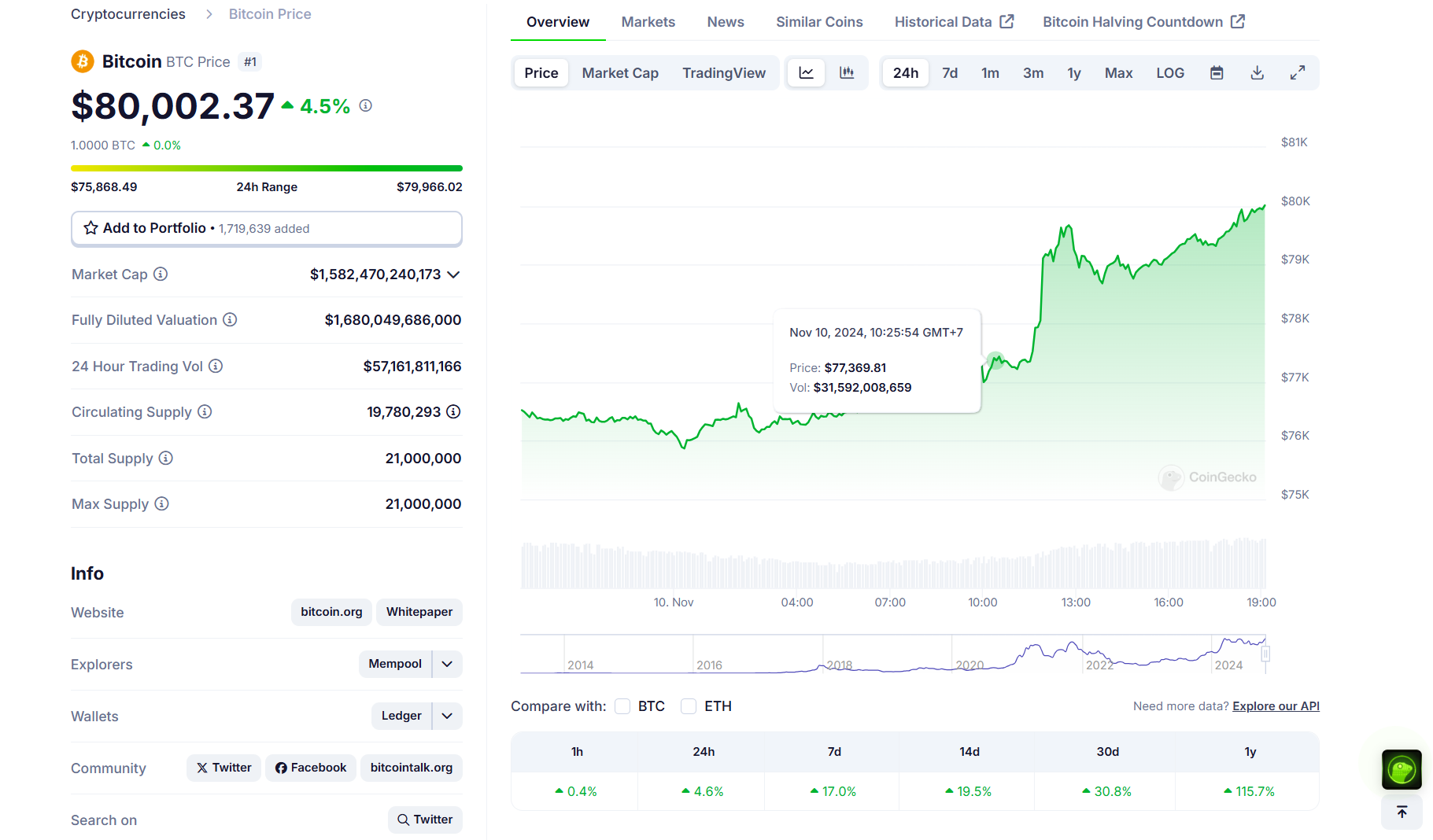

MicroStrategy’s unrealized beneficial properties have skyrocketed amid Bitcoin’s worth rally. Bitcoin reached $77,000 following Donald Trump’s election victory and the Fed’s rate of interest determination, earlier than hovering to $80,000 earlier right this moment, in line with CoinGecko data.

On the time of reporting, BTC was buying and selling at round $79,700, up over 4% within the final 24 hours and roughly 118% year-to-date.

Trump’s reelection as US president has sparked optimism about favorable crypto regulations. He has demonstrated help for digital belongings by collaborating in trade occasions, together with the Bitcoin 2024 Convention.

Current financial coverage shifts have additionally contributed to the rally, with each the US Fed and Financial institution of England implementing 25 basis point rate cuts on Thursday.

The broader crypto market has benefited from Bitcoin’s momentum, with Ethereum rising over 5%, Solana gaining 2%, and Dogecoin leaping 14%. The whole crypto market cap has soared to $2.8 trillion, up over 3% over the previous 24 hours.

MicroStrategy’s inventory surges almost 330% this 12 months

Not solely has MicroStrategy’s Bitcoin guess yielded large beneficial properties, however its inventory efficiency has additionally risen.

Bitcoin’s rally not too long ago lifted MicroStrategy’s inventory to $270, its highest stage in 25 years, data from Yahoo Finance exhibits. The inventory has elevated roughly 330% year-to-date.

With a give attention to growing shareholder worth by digital asset administration and leveraging capital markets, MicroStrategy goals to proceed increasing its Bitcoin reserves and enhancing total profitability within the coming years.

In accordance with its Q3 earnings report, MicroStrategy plans to boost $42 billion over the subsequent three years, cut up evenly between fairness and fixed-income securities to finance additional Bitcoin purchases.

Share this text