Home » Bitcoin » MARA Holdings upsizes word providing to $850 million to purchase extra Bitcoin

The notes is not going to pay common curiosity funds to the bondholders.

Photograph: mara.com

Share this text

MARA Holdings (MARA), Wall Road’s largest publicly traded Bitcoin miner, has elevated its convertible senior notes providing to $850 million from $700 million, with plans to make use of a part of the online proceeds for future Bitcoin acquisitions, based on a Dec. 2 statement. MARA Holdings, Inc. Proclaims Pricing of Oversubscribed and Upsized Providing of Zero-Coupon Convertible Senior Notes due 2031https://t.co/3PYqjzn2A7

— MARA (@MARAHoldings) December 3, 2024

The zero-interest notes, maturing in 2031, are convertible into money, widespread inventory shares, or a mix of each on the firm’s discretion.

The Bitcoin mining firm expects to generate roughly $835 million in web proceeds from the providing, with potential to succeed in $982 million if further notes are totally bought.

MARA plans to allocate $48 million of the proceeds to repurchase about $51 million of current convertible notes due in 2026.

The majority of the remaining web proceeds from the sale of the notes will likely be directed in the direction of buying further Bitcoin. These funds will even be used to assist varied company initiatives, similar to strategic acquisitions.

The corporate not too long ago acquired 703 Bitcoin in November, bringing its month-to-month whole purchases to 6,474 BTC, after raising $1 billion by way of a earlier zero-interest convertible senior word sale. Marathon additionally put aside $160 million to purchase the dip.

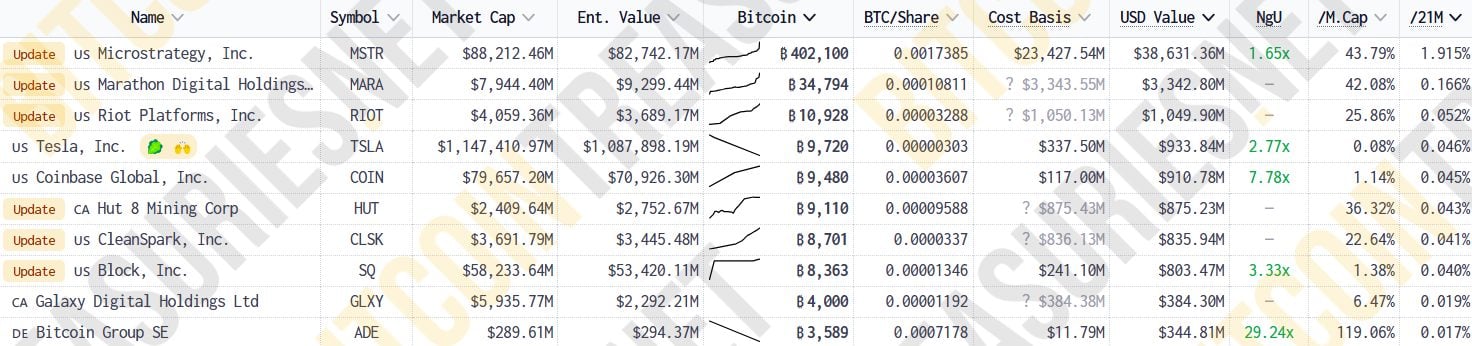

MARA now holds 34,794 Bitcoin valued at $3.3 billion, reinforcing its place because the second-largest company Bitcoin holder behind MicroStrategy, which not too long ago purchased $1.5 billion price of Bitcoin.

Share this textKey Takeaways