MAIN POINTS

- SEC Chair Gary Gensler has indicated his intention to step down following President-elect Donald Trump’s victory.

- The potential for a extra lenient SEC stance has already influenced the market, with $XRP seeing a big 17% surge.

- The crypto business is hopeful that a new SEC regime could loosen up restrictions on ETF staking. This might improve returns and entice extra buyers to Ethereum-based funds.

- A shift towards clearer and extra supportive rules may stimulate progress, entice investments, and place the US as a frontrunner in digital finance.

Did you are feeling the earth shifting beneath your toes?

That’s the regulatory US cryptocurrency panorama on the verge of a seismic shift.

SEC Chair Gary Gensler signifies that he could step down from his place following the election of President-elect Donald Trump.

Will the change on the helm of the Securities and Alternate Fee (SEC) herald a extra favorable regulatory surroundings for digital property?

Let’s take a more in-depth take a look at the profound implications for the business as a complete.

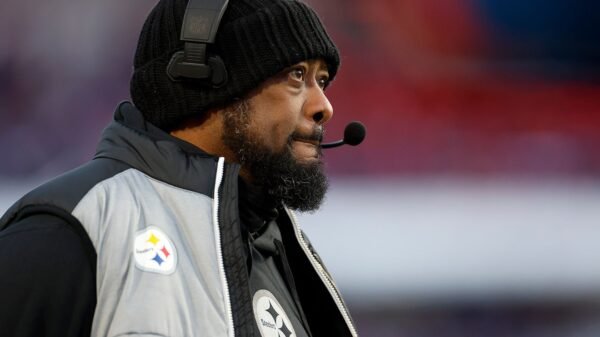

Gary Gensler’s Tenure: A Powerful Stance on Crypto

Since taking workplace in April 2021, Gary Gensler gained a status for a very, uh, rigorous strategy towards crypto regulation.

Beneath his management, the SEC took a extra aggressive stance towards numerous crypto initiatives (like Ripple and Immutable), exchanges (like Crypto.com), and token choices.

Gensler justified the extra aggressive strategy by persistently sustaining that almost all cryptocurrencies are securities, which implies they fall beneath the SEC’s oversight.

This place has been a degree of competition, notably amongst crypto lovers and corporations. They argue for a clearer regulatory framework tailor-made particularly to digital property.

In a recent speech, Gensler defended his observe document.

He emphasised that his actions had been backed by judicial rulings. And that they had been crucial to guard buyers from potential fraud and market manipulation.

Critics argue that his aggressive stance stifled innovation within the burgeoning sector, which led to uncertainty that drove some crypto firms and crypto expertise abroad.

A Shift Towards a Extra Crypto-Pleasant SEC?

In the identical speech, Gensler indicated that he would comply with regular precedent and resign after President-elect Donald Trump takes workplace.

Many within the crypto business see it as a possibility for a recent begin.

Trump’s marketing campaign is signaling a extra open-minded strategy to digital property. So, there’s a robust risk the brand new SEC chair might be extra amenable to crypto-friendly rules.

The crypto business hopes for an more and more balanced strategy, the place the focus shifts from enforcement to fostering innovation and progress within the business.

Favorable rules may alleviate a few of the challenges crypto corporations face, such because the ambiguous classification of digital property and stringent compliance necessities.

No matter the brand new SEC chair does, market individuals are hoping for clearer pointers.

SEC Ripple Impact on the Market

The potential for a altering regulatory surroundings is already impacting the cryptocurrency market.

$XRP, the native token of Ripple Labs, surged 17% in 24 hours, outperforming different main cryptocurrencies.

Over the previous week – mainly, because the election – $XRP has outperformed even $BTC.

This rally comes on the heels of Ripple’s ongoing legal battle with the SEC, the place it has managed to attain some partial victories.

The prospect of a extra lenient SEC regulatory strategy may gain advantage Ripple, which is combating the identical battle over whether or not most crypto tokens – like $XRP – rely as securities.

In the meantime, Bitcoin’s rally appears to have slowed slightly, however merchants stay bullish. Some keep a $120K goal for the main cryptocurrency.

Ethereum and the Way forward for Staking in ETFs

One space of explicit curiosity is whether or not the SEC will view staking in another way inside the context of exchange-traded funds (ETFs).

At present, the SEC prohibits the inclusion of staking property in ETFs, which limits the potential returns these funds can provide buyers.

Staking, which entails locking up crypto property to assist validate transactions on a blockchain community in trade for rewards, is a well-liked technique amongst Ethereum holders.

If the SEC relaxed its stance on staking, it may pave the best way for ETFs that embody staked property, offering buyers with a brand new passive earnings avenue.

It might present a key (and much-needed) benefit for $ETH ETFs.

At present, there’s not a lot separating an Ethereum ETF from a Bitcoin ETF besides the underlying efficiency of the cryptocurrencies themselves.

And on that entrance, $BTC is up 149% over the previous 12 months.

$ETH is up solely 56%.

That explains why US Spot $BTC ETFs have seen cumulative internet inflows of $27B, whereas the identical $ETH ETFs have solely seen $238M cumulative internet inflows.

What a New Regulatory Panorama May Imply

The upcoming SEC adjustments might be a turning level for the US cryptocurrency business, which has lengthy been in regulatory limbo.

A extra supportive regulatory framework may spur progress, entice funding, and cement the US as a worldwide chief in digital finance.

If Trump’s appointed successor to Gary Gensler takes a extra balanced strategy, it may foster an surroundings the place the business can thrive with out concern of sudden regulatory crackdowns.

Within the meantime, the crypto market is bracing for the same old volatility.

The subsequent few months may show pivotal, not only for regulatory coverage but in addition for the broader adoption of digital property.

References

Add Techreport to Your Google Information Feed

Get the most recent updates, tendencies, and insights delivered straight to your fingertips. Subscribe now!

Aaron covers crypto subjects with an emphasis on offering accessible, informative views. His background consists of over a decade in larger schooling and 5+ years as a contract author in crypto & search engine optimization.

When he is not writing professionally, Aaron enjoys writing for enjoyable, volunteering for an area charity, and boxing.

The Tech Report editorial coverage is centered on offering useful, correct content material that provides actual worth to our readers. We solely work with skilled writers who’ve particular information within the subjects they cowl, together with newest developments in expertise, on-line privateness, cryptocurrencies, software program, and extra. Our editorial coverage ensures that every matter is researched and curated by our in-house editors. We keep rigorous journalistic requirements, and each article is 100% written by actual authors.