- Gold surges to contemporary all-time excessive as safe-haven demand rises forward of Trump’s auto tariff deadline.

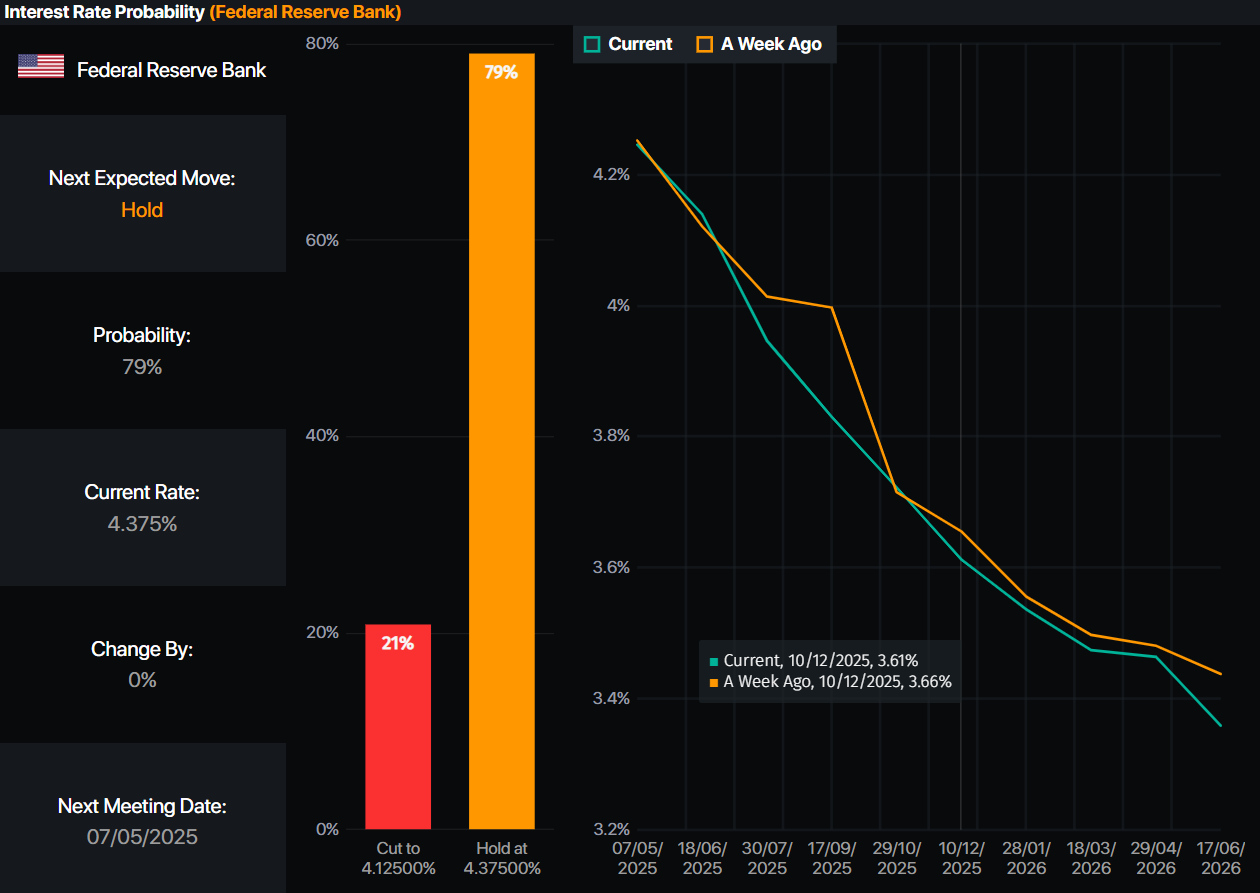

- Regardless of core PCE uptick, Fed’s Daly sees two cuts in 2025; market now pricing in 73.5 bps of easing.

- DXY weakens, US yields slide, and world tensions mount as Canada and EU prep retaliation plans.

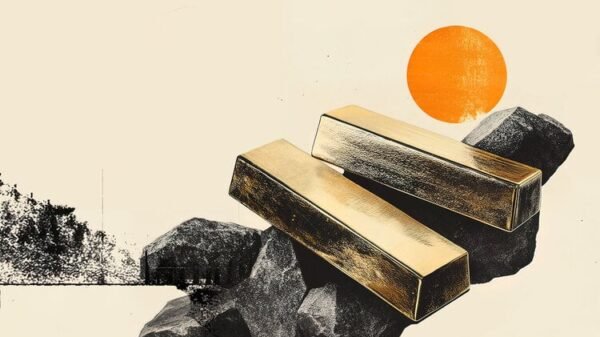

Gold worth rallied sharply on Friday, hitting a brand new report excessive of $3,086 amid uncertainty over US commerce coverage, alongside an uptick within the Federal Reserve’s (Fed) most popular inflation gauge. After this, merchants appear assured that the Fed will reduce rates twice in 2025. The XAU/USD trades at 3079, up 0.79%.

The market temper is pessimistic as merchants brace for April 2, the so-called “Liberation Day” by US President Donald Trump, who signed an government order making use of 25% tariffs on all automobiles imported to the US. This triggered reactions worldwide, primarily in Canada and the European Union (EU), which has begun getting ready to retaliate in opposition to this measure.

Within the meantime, the Buck stays battered and is about to complete the week with losses of 0.11%, in line with the US Greenback Index (DXY), which underpins the costs of valuable metals. US yields are additionally dropping as buyers looking for security piled into Bullion and the Japanese Yen (JPY).

The US financial calendar revealed that the Core Private Consumption Expenditures (PCE) Worth Index in February was largely aligned with forecasts, whereas the College of Michigan Shopper Sentiment survey in March deteriorated additional.

Apart from this, San Francisco Fed Mary Daly said that she foresees two price cuts in 2025, including just lately that she is concentrated 100% on inflation attributable to progress being flat.

In the meantime, cash markets have priced in 73.5 foundation factors of Fed easing in 2025, leaping ten foundation factors from the day before today, in line with Prime Market Terminal rate of interest possibilities.

Supply: Prime Market Terminal

Subsequent week, the US financial docket will characteristic the April 2 Trump tariff announcement, the ISM Manufacturing PMI for March, JOLTS Job Openings and Nonfarm Payrolls.

Every day digest market movers: Gold costs set to problem $3,100 within the quick time period

- The US 10-year T-note yield is plummeting, down ten foundation factors at 4.259%. US actual yields edge down seven and a half bps to 1.887%, in line with US 10-year Treasury Inflation-Protected Securities (TIPS) yields.

- The Private Consumption Expenditures (PCE) Worth Index held regular at 2.5% YoY in February, in line with the US Bureau of Financial Evaluation.

- Core PCE, which excludes meals and vitality, rose 2.8% YoY, up barely from the upwardly revised 2.7% within the earlier month. Whereas largely sustaining the established order, these readings point out that inflation stays above the Fed’s 2% goal.

- The College of Michigan’s Shopper Sentiment Index dipped from a preliminary 57.9 to 57.0, as US households grew extra pessimistic.

- One-year inflation expectations climbed to five%, whereas five-year expectations rose from 3.9% to 4.1%, reflecting rising shopper considerations over future worth pressures.

XAU/USD technical outlook: Gold worth rallies previous $3,050, eyes on $3,100

Gold’s rally continues with the yellow metallic poised to hit a report excessive of $3,086, clearing the trail to problem $3,100. Momentum means that Bullion costs appear poised to increase their good points, previous the latter, with the psychological $3,150 and $3,200 uncovered if cleared.

Because of the aggressiveness of the uptrend, the Relative Power Index (RSI) turned overbought, exceeding 70. Nonetheless, probably the most excessive studying can be 80 as of the time of writing. Conversely, if the XAU/USD drops under March’s excessive of $3,057, this might exacerbate a pullback towards $3,000.

Tariffs FAQs

Tariffs are customs duties levied on sure merchandise imports or a class of merchandise. Tariffs are designed to assist native producers and producers be extra aggressive out there by offering a worth benefit over comparable items that may be imported. Tariffs are extensively used as instruments of protectionism, together with commerce limitations and import quotas.

Though tariffs and taxes each generate authorities income to fund public items and providers, they’ve a number of distinctions. Tariffs are pay as you go on the port of entry, whereas taxes are paid on the time of buy. Taxes are imposed on particular person taxpayers and companies, whereas tariffs are paid by importers.

There are two faculties of thought amongst economists relating to the utilization of tariffs. Whereas some argue that tariffs are needed to guard home industries and deal with commerce imbalances, others see them as a dangerous instrument that would probably drive costs increased over the long run and result in a harmful commerce conflict by encouraging tit-for-tat tariffs.

Throughout the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to make use of tariffs to help the US financial system and American producers. In 2024, Mexico, China and Canada accounted for 42% of whole US imports. On this interval, Mexico stood out as the highest exporter with $466.6 billion, in line with the US Census Bureau. Therefore, Trump desires to give attention to these three nations when imposing tariffs. He additionally plans to make use of the income generated by way of tariffs to decrease private earnings taxes.

Data on these pages comprises forward-looking statements that contain dangers and uncertainties. Markets and devices profiled on this web page are for informational functions solely and mustn’t in any manner come throughout as a suggestion to purchase or promote in these belongings. You need to do your individual thorough analysis earlier than making any funding selections. FXStreet doesn’t in any manner assure that this info is free from errors, errors, or materials misstatements. It additionally doesn’t assure that this info is of a well timed nature. Investing in Open Markets entails an excessive amount of threat, together with the lack of all or a portion of your funding, in addition to emotional misery. All dangers, losses and prices related to investing, together with whole lack of principal, are your duty. The views and opinions expressed on this article are these of the authors and don’t essentially mirror the official coverage or place of FXStreet nor its advertisers. The creator won’t be held chargeable for info that’s discovered on the finish of hyperlinks posted on this web page.

If not in any other case explicitly talked about within the physique of the article, on the time of writing, the creator has no place in any inventory talked about on this article and no enterprise relationship with any firm talked about. The creator has not acquired compensation for writing this text, apart from from FXStreet.

FXStreet and the creator don’t present customized suggestions. The creator makes no representations as to the accuracy, completeness, or suitability of this info. FXStreet and the creator won’t be chargeable for any errors, omissions or any losses, accidents or damages arising from this info and its show or use. Errors and omissions excepted.

The creator and FXStreet should not registered funding advisors and nothing on this article is meant to be funding recommendation.