Final week, Bitcoin (BTC) skilled important volatility. Conflicting market indicators created bearish stress, stopping merchants from setting a transparent directional development. Consequently, main altcoins like Ethereum and XRP dropped beneath essential value factors. Nevertheless, following hints from US CPI and PPI knowledge that inflation could also be easing, the market rallied, setting the stage for a probably bullish week forward.

Curiosity Fee Choice Might Revive Crypto

Amid a 2% drop final week, Bitcoin continues to face important draw back dangers resulting from a number of bearish macroeconomic pressures.

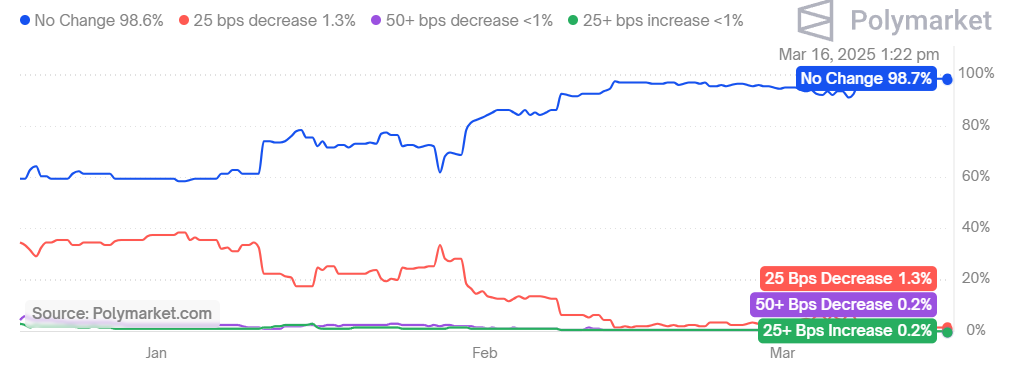

On a brighter word, analysts within the crypto prediction markets, corresponding to Polymarket, are optimistic a couple of potential pause in Federal Reserve fee hikes subsequent week. Moreover, there’s rising hope that geopolitical tensions between Russia and Ukraine would possibly ease.

Bettors on Polymarket are pricing in a 99% probability of the Fed pausing fee hikes in March, with the percentages of a Russia-Ukraine ceasefire reaching practically 80%. Ought to these developments happen, a surge in threat urge for food might result in elevated investments in Bitcoin and different cryptocurrencies, probably triggering additional upward momentum subsequent week.

Bitcoin Value Prediction

Bitcoin bulls are trying a restoration, although they’re more likely to encounter important resistance between the EMA20 development line and the $86.7K mark. At the moment, the BTC value stands at $84,262, having risen by 0.09% previously 24 hours.

If the worth stays above the 20-day EMA, it might counsel that the current dip beneath $84K was merely a bear lure. Underneath such circumstances, the BTC/USDT pair would possibly climb to the essential $86.7K stage and probably lengthen to $93,000.

Alternatively, if the worth sharply declines from this resistance zone, it will counsel that bears have the higher hand. This might enhance the probability of a drop to the essential assist stage at $79,974.

Ethereum Value Prediction

Ether has been dealing with rising volatility across the descending resistance line, suggesting rising domination amongst patrons and sellers. ETH value has been consolidating beneath the essential $2K mark. As of writing, ETH value trades at $1,923, surging over 0.2% within the final 24 hours.

The Relative Energy Index (RSI) is starting to exhibit early indicators of a optimistic divergence. Ought to the worth breach the EMA50 development line, the ETH/USDT pair would possibly ascend to the breakdown stage of $2,109. At this stage, bears would possibly intensify their promoting efforts; nevertheless, if the bulls handle to maintain their momentum, the pair might advance in the direction of the 50-day SMA at $2,530.

This optimistic outlook could be invalidated if the worth fails to carry at $2,109 and subsequently falls beneath $1,772. Such a transfer would point out a bearish dominance.

XRP Value Prediction

XRP bounced off the $2 assist stage and broke above the EMA20 development line on the 1-hour chart. Bears are trying to cease the restoration at this EMA, however continued shopping for stress from bulls suggests a possible breakout above it.

If profitable, the XRP/USDT pair might climb to $2.65. Surpassing this stage would possibly set the stage for a rally to $2.97.

Conversely, a pointy decline from the present stage would point out that sentiment stays bearish. In such a case, the pair would possibly revisit the essential $2 assist.

We would Like to Hear Your Ideas on This Article!

Was this writing useful?