![]()

contributor

Posted:

Share this text

- Binance trade noticed sturdy development in stablecoin inflows, aiding in its market dominance

- A recap of BSC community exercise and BNB’s value motion is value highlighting too

Binance’s dominance is changing into extra obvious and influential because the market continues to warmth up. The truth is, latest reviews counsel that the crypto trade has been noting a surge in stablecoins recently and thus, liquidity.

In response to a latest CryptoQuant analysis, Binance at the moment controls roughly 67% of the full stablecoin reserves held on all exchanges. In different phrases, it’s the most liquid trade. Subsequently, it has the most important impression on flows into cryptocurrencies.

Binance has reportedly recorded over $22 billion value of stablecoin inflows in 2024 to this point. This makes it the largest driver of demand in crypto on this 12 months. Moreover, this has technically allowed Binance to safe extra transaction exercise and may translate to extra income.

Binance sensible chain community exercise recap

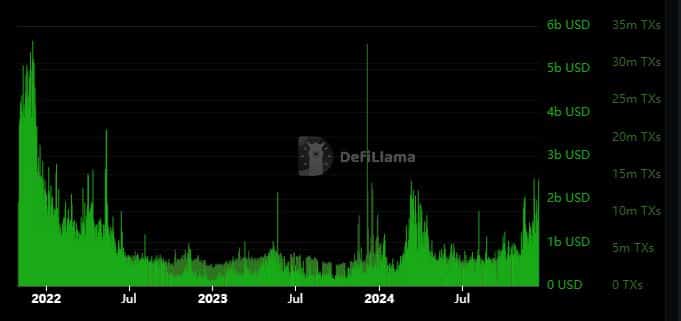

In response to DeFiLlama, stablecoin marketcap on the Binance Sensible Chain (BSC) grew significantly in 2024. The bottom stablecoin marketcap recorded in the course of the 12 months was $32.71 million on 21 January.

This was courtesy of a short-lived dip, which shortly recovered again above $4 billion.

The BSC’s stablecoin marketcap grew considerably during the last 3 months. It bounced from round $5.01 billion at the beginning of November and rallied to $6.60 billion by 13 December. Right here, it’s value noting, nonetheless, that this largely represented the liquidity within the community and never the trade itself.

BSC volumes have additionally improved significantly to this point in This fall. Quantity peaked at $2.43 billion within the final 24 hours, which marked the second time this month that it surged previous the $2 billion-mark.

Regardless of the latest surge, quantity was nowhere close to the historic peak ranges noticed on the peak of the bull market in 2021. In the meantime, transaction rely additionally grew from the three million every day transaction vary in September, to over 5 million transactions.

BNB’s value recap

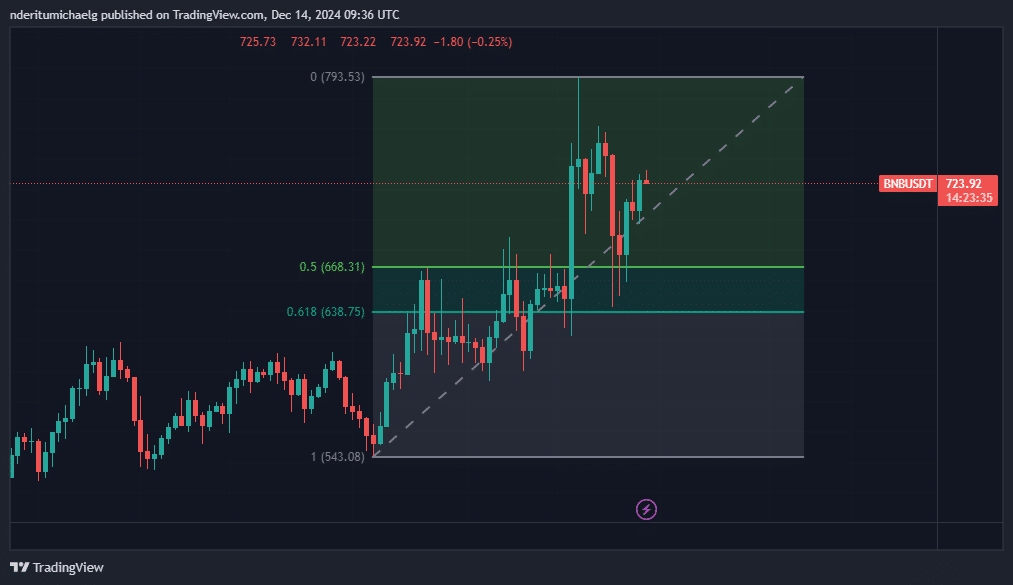

BNB has arguably benefited immensely from the bullish exercise in 2024, judging by its bullish disposition. On the shorter timeframes, BNB kicked off this week on a bearish leg, characterised by a pointy dip from its latest ATH.

The pullback noticed the value drop as little as $642. Nevertheless, this additionally resulted in a retracement inside a key Fibonacci retracement zone and the value has since bounced again above $700. The altcoin was valued at $723.91, on the time of writing.

The retracement dashed hopes of the value pushing above $800. Nevertheless, the altcoin’s latest restoration within the second half instructed that the value might nonetheless rally above that concentrate on earlier than the tip of the month.