Home » Markets » Australia’s tremendous fund allocates $27 million to Bitcoin

AMP embraces Bitcoin, marking a milestone in institutional crypto adoption in Australia regardless of business skepticism.

Key Takeaways

- AMP allotted $27 million to Bitcoin, marking Australia’s first tremendous fund funding within the digital asset.

- The Bitcoin funding goals to boost returns and handle danger as a part of AMP’s diversification technique.

Share this text

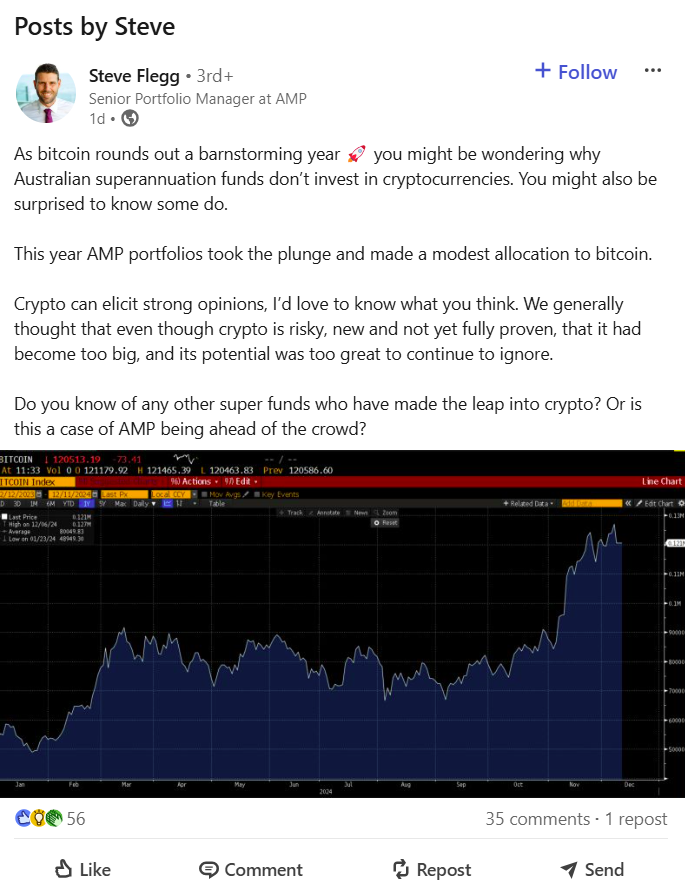

AMP has grow to be Australia’s first superannuation fund to spend money on Bitcoin. The corporate confirmed Thursday it had allotted roughly $27 million, or 0.05% of its $57 billion in property below administration, to the crypto asset, buying it at costs between $60,000 and $70,000.

Phrases began getting round following Steve Flegg’s LinkedIn submit, the place the AMP senior portfolio supervisor acknowledged that the agency had “taken the plunge” as Bitcoin wrapped up a “barnstorming yr.”

The wealth and pensions supervisor opted so as to add “a small and risk-controlled place” to its Dynamic Asset Allocation program after thorough testing and consideration by its funding staff, mentioned Stuart Eliot, AMP’s head of portfolio administration, in a latest interview with Tremendous Assessment.

The Bitcoin funding is a part of a broad diversification technique to boost returns and handle danger, in keeping with Eliot. AMP is recognizing the rising pattern of institutional buyers coming into the crypto market, as evidenced by the launch of many crypto ETFs over the past yr.

AMP’s funding marks a milestone for public-offer tremendous funds, according to College of NSW economist Richard Holden, who famous that self-managed tremendous funds already maintain $2 billion to $3 billion in crypto property.

Caroline Bowler, chief govt of Australia-based crypto trade BTC Markets, supported the transfer, stating:

“The crypto market has grown too vital to disregard. It’s not simply concerning the buzz, it’s about the actual potential Bitcoin holds as a part of a diversified funding technique.”

Business-wide skepticism

Many different main funds, together with AustralianSuper, Australian Retirement Belief, and MLC, have expressed skepticism about direct crypto investments.

Superannuation fund AustralianSuper, the biggest in Australia, mentioned it could not comply with AMP’s lead, however has explored blockchain investments.

Australian Retirement Belief, managing A$230 billion in property, mentioned it has no plans to spend money on crypto or Bitcoin within the close to future.

As with AustralianSuper and Australian Retirement Belief, MLC shouldn’t be investing in crypto at current, however it’s open to the chance sooner or later. MLC’s chief funding officer Dan Farmer acknowledged it was a case of “not but, relatively than not ever” relating to crypto investments.

Share this text