- Aussie edges up 0.33%, consolidating round 0.6200.

- Markets digest US PCE knowledge for coverage cues.

- Fed is seen holding charges regular in early 2025.

The Australian Greenback consolidates round 0.6200 on Friday as merchants digest November’s US Private Consumption Expenditures (PCE) inflation knowledge. With the Federal Reserve (Fed) anticipated to maintain rates of interest regular on the first 2025 coverage assembly, traders additionally await subsequent week’s Reserve Financial institution of Australia (RBA) minutes for perception into potential charge strikes.

Comfortable US PCE figures are tempering the Dollar’s power, providing modest help to the Aussie’s nascent rebound.

Day by day digest market movers: Aussie sees delicate rebound as markets digest tender PCE knowledge

- The US Greenback Index eased after hitting a two-year excessive at 108.50, as PCE knowledge undercut inflation expectations.

- The US November PCE month-to-month headline studying got here in at 0.1%, down from 0.2%.

- The yearly measure rose at 2.4% YoY, barely under the two.5% forecast.

- Core PCE slipped to 0.1% month-to-month from 0.3%, with the annual determine regular at 2.8% and below the two.9% estimate.

- RBA minutes due Tuesday might make clear future coverage strikes after Governor Michele Bullock expressed confidence in easing wage and demand pressures.

- China’s sluggish progress outlook and potential US tariffs nonetheless cap Aussie upside, although immediately’s softer US knowledge presents a short reprieve.

AUD/USD technical outlook: Aussie finds footing as oversold alerts fade

The AUD/USD is extending its good points for a second consecutive day. The Relative Power Index (RSI) stands close to 33, rebounding from oversold territory, whereas the Transferring Common Convergence Divergence (MACD) histogram prints flat purple bars.

Though momentum stays fragile, the pair’s modest restoration and enhancing technical alerts counsel it could stabilize additional if incoming knowledge continues to mood the US Greenback’s power.

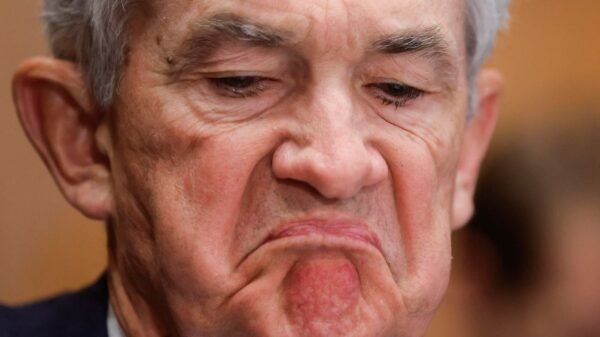

Fed FAQs

Financial coverage within the US is formed by the Federal Reserve (Fed). The Fed has two mandates: to realize value stability and foster full employment. Its main device to realize these objectives is by adjusting rates of interest. When costs are rising too rapidly and inflation is above the Fed’s 2% goal, it raises rates of interest, growing borrowing prices all through the economic system. This ends in a stronger US Greenback (USD) because it makes the US a extra enticing place for worldwide traders to park their cash. When inflation falls under 2% or the Unemployment Fee is just too excessive, the Fed might decrease rates of interest to encourage borrowing, which weighs on the Dollar.

The Federal Reserve (Fed) holds eight coverage conferences a yr, the place the Federal Open Market Committee (FOMC) assesses financial situations and makes financial coverage choices. The FOMC is attended by twelve Fed officers – the seven members of the Board of Governors, the president of the Federal Reserve Financial institution of New York, and 4 of the remaining eleven regional Reserve Financial institution presidents, who serve one-year phrases on a rotating foundation.

In excessive conditions, the Federal Reserve might resort to a coverage named Quantitative Easing (QE). QE is the method by which the Fed considerably will increase the circulation of credit score in a caught monetary system. It’s a non-standard coverage measure used throughout crises or when inflation is extraordinarily low. It was the Fed’s weapon of alternative in the course of the Nice Monetary Disaster in 2008. It entails the Fed printing extra {Dollars} and utilizing them to purchase excessive grade bonds from monetary establishments. QE normally weakens the US Greenback.

Quantitative tightening (QT) is the reverse technique of QE, whereby the Federal Reserve stops shopping for bonds from monetary establishments and doesn’t reinvest the principal from the bonds it holds maturing, to buy new bonds. It’s normally constructive for the worth of the US Greenback.

Info on these pages incorporates forward-looking statements that contain dangers and uncertainties. Markets and devices profiled on this web page are for informational functions solely and mustn’t in any method come throughout as a advice to purchase or promote in these belongings. You must do your personal thorough analysis earlier than making any funding choices. FXStreet doesn’t in any method assure that this info is free from errors, errors, or materials misstatements. It additionally doesn’t assure that this info is of a well timed nature. Investing in Open Markets entails a substantial amount of danger, together with the lack of all or a portion of your funding, in addition to emotional misery. All dangers, losses and prices related to investing, together with whole lack of principal, are your accountability. The views and opinions expressed on this article are these of the authors and don’t essentially replicate the official coverage or place of FXStreet nor its advertisers. The creator is not going to be held chargeable for info that’s discovered on the finish of hyperlinks posted on this web page.

If not in any other case explicitly talked about within the physique of the article, on the time of writing, the creator has no place in any inventory talked about on this article and no enterprise relationship with any firm talked about. The creator has not obtained compensation for writing this text, aside from from FXStreet.

FXStreet and the creator don’t present personalised suggestions. The creator makes no representations as to the accuracy, completeness, or suitability of this info. FXStreet and the creator is not going to be chargeable for any errors, omissions or any losses, accidents or damages arising from this info and its show or use. Errors and omissions excepted.

The creator and FXStreet will not be registered funding advisors and nothing on this article is meant to be funding recommendation.