Photograph by Costfoto/NurPhoto through Getty Pictures

Conventional pillars of economic stability, comparable to gold and international foreign money reserves, now face scrutiny in an period of inflationary pressures, financial sanctions, and the demand for sovereignty over nationwide property. Gold and fiat currencies have dominated nationwide reserves for hundreds of years, however a brand new period calls for revolutionary options. May Bitcoin, the world’s first decentralized digital foreign money, emerge as the answer to those ever-growing points?

Latest developments point out a rising pattern amongst nations contemplating Bitcoin as a part of their monetary technique. El Salvador’s audacious determination in 2021 to undertake Bitcoin as authorized tender and set up a nationwide Bitcoin reserve ignited a world debate on the way forward for reserve property. As of December 2024, the federal government holds roughly 5,944 bitcoins, valued at over $560 million, aiming to leverage Bitcoin’s potential to strengthen its financial system. In the meantime, legislators in Brazil have launched a bill to create a Sovereign Strategic Bitcoin Reserve (RESBit), proposing to allocate as much as 5% of Brazil’s worldwide reserves to Bitcoin.

Even within the US, discussions have emerged about establishing a strategic Bitcoin reserve. President-elect Donald Trump has proposed creating a ‘Strategic National Bitcoin Stockpile,’ suggesting that the US authorities retain bitcoins acquired by means of asset forfeitures to bolster nationwide monetary safety.

A Imaginative and prescient for Bitcoin-Backed Treasury Administration

With over a decade of market endurance, Bitcoin gives nations a hedge in opposition to inflation, unparalleled transparency by means of blockchain, and the potential to outpace gold because the dominant reserve asset. This trillion-dollar alternative emphasizes the necessity for safe storage, clear authorized frameworks, and balanced diversification with conventional property, paving the best way for a future-proof monetary system.

Stelian Balta, founding father of HyperChain Capital, embodies a forward-thinking strategy to financial resilience in a quickly shifting monetary panorama. With experience that spans blockchain expertise and macroeconomic technique, Balta sees Bitcoin as an asset and a transformational device for reimagining treasury frameworks. “Throughout the subsequent decade, Bitcoin will surpass gold because the world’s main retailer of worth, which might indicate a value of a minimum of $1 million per Bitcoin. Being available in the market for 12 years, I’ve seen it survive and thrive by means of each storm as an asset class. Ahead-thinking nations ought to take into consideration transferring from gold to Bitcoin.

Almost certainly, the USA will prepared the ground and different nations are more likely to observe go well with. This presents a trillion-dollar alternative, providing a mathematically confirmed hedge in opposition to inflation and a extra dynamic retailer of worth for the longer term.”

Equally, Matthew Ferranti, an economist with the US Intelligence Community, factors to Bitcoin’s resistance to monetary sanctions as a crucial benefit for nations navigating geopolitical uncertainties: “To the extent that gold is a reserve asset, so is Bitcoin.” Not like conventional reserve property held in international custodial accounts, Bitcoin gives the potential for self-custody, decreasing reliance on third-party establishments that will freeze or prohibit entry to property in politically tense eventualities.

MicroStrategy, led by Michael Saylor, has already pioneered Bitcoin-backed treasury administration on the company degree. As of December 23, 2024, the corporate has accumulated over 444,262 bitcoins as a part of its strategic reserve technique, showcasing how Bitcoin can function a cornerstone for long-term worth preservation and monetary agility.

As an entire, Balta’s imaginative and prescient for integrating Bitcoin into nationwide reserves facilities on simplicity and strategic foresight by means of 4 primary pillars:

- Authorized Infrastructure: “Readability is a very powerful authorized basis for paving the best way for Bitcoin as a reserve asset. Governments should codify Bitcoin’s standing as a reserve asset to foster confidence and stability throughout sectors.”

- Safety Protocols: “We’d like state-of-the-art multi-signature storage options. This minimizes dangers whereas safeguarding the reserves in opposition to potential threats.”

- Transparency: “Unbiased audits and open disclosures guarantee belief, not simply amongst residents but in addition amongst international stakeholders.”

- Strategic Integration: “Bitcoin shouldn’t stand alone. It ought to complement conventional reserves like gold and fiat, forming a balanced and dynamic portfolio.”

Blockchain’s Influence on Governance and On-Chain Asset Administration

Past its function as a reserve asset, Bitcoin is a tangible expression of the broader promise of blockchain expertise to redefine governance and asset administration. The UK Treasury has already explored how on-chain asset administration may rework the funding panorama by leveraging tokenization.

Functions comparable to tokenized property serving as collateral for cash market funds and their integration into totally on-chain markets show the potential to enhance effectivity, transparency, and accountability throughout the funding sector.

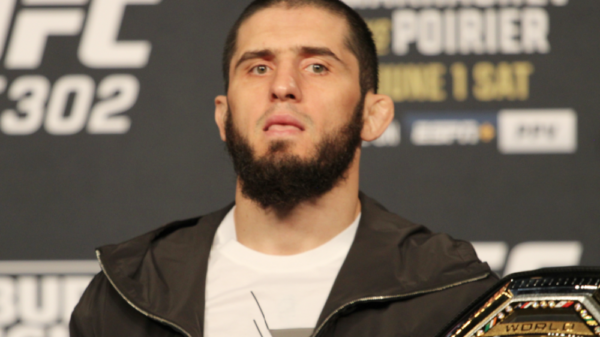

Stelian Balta

“Blockchain is a lot extra than simply foreign money innovation,” Balta asserts. “It’s a device for rebuilding belief, creating efficiencies, and guaranteeing accountability throughout monetary programs.” Balta envisions a future the place monetary programs totally function on-chain, offering verifiability and readability at each degree. “On-chain asset administration transforms monetary programs because it conjures up confidence by providing accountability for private and non-private entities alike.”

Backside Line

The geopolitical affect of the twenty first century revolves round monetary sovereignty. For nations keen to behave boldly, Bitcoin gives a blueprint for the longer term: safe reserves safeguarded by cutting-edge expertise, transparency that builds belief at each degree, and the agility to thrive in unstable geopolitical landscapes.