Comparatively low-cost housing, low taxes, looser COVID-19 restrictions and an inflow of main employers turned Texas housing markets into hotspots after the pandemic started in March 2020.

There weren’t many metro areas that rivaled the increase in Austin. The rising know-how sector introduced wealth from the West Coast and pushed house costs sky excessive in a really quick time period.

Whereas Houston, Dallas and San Antonio didn’t expertise the identical tempo of value appreciation, they benefited from the identical dynamics that pushed Austin to the moon.

However the momentum in Texas has stalled. Over the previous six months, home prices have fallen in all 4 of the state’s main metropolitan areas because the extraordinarily tight stock that outlined the years following the pandemic has loosened significantly.

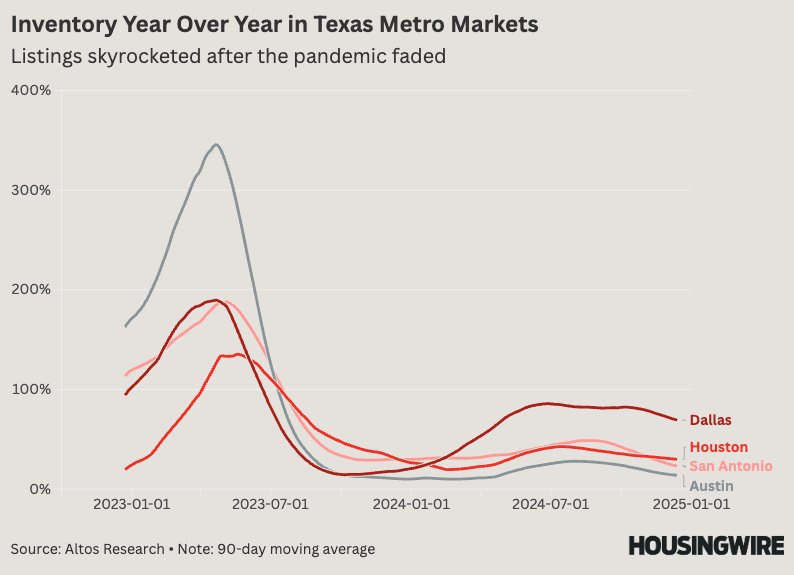

This dynamic is painfully evident in information from Altos Research, and it’s most blatant in Austin. The year-over-year median value change in “child San Jose” turned unfavourable on the finish of 2022. In Could 2023, the annualized decline bottomed out at a hefty 13.2%.

Costs in the beginning of 2024 turned optimistic once more. However since then, they’ve settled right into a sample of yearly declines within the vary of 4.5%.

One doesn’t should wade via the weeds of housing market information to determine why. Yr-over-year stock progress in Austin tripled and quadrupled for a lot of 2023. Stock progress peaked at a surprising 345.8% in April 2023.

The identical dynamic has performed out in Houston, San Antonio and Dallas, though to not the identical extent as Austin.

Dallas has skilled the best year-over-year stock spike of the three different main Texas metros. It topped out in April 2023 at 189.7%, barely besting San Antonio’s 188% year-over-year rise in Could 2023. Houston had its stock progress peak at 135% proper across the similar time.

In 2024, stock features have been pretty regular. In June, progress in Dallas settled in at about 85%. Austin’s will increase have fallen from 28% in August to 14% as we speak, whereas Houston (+30%) and San Antonio (+23%) proceed to see comparatively modest progress.