Forward of the NFL playoffs and the upcoming holidays, an unbiased company in the US accountable for shopper safety within the monetary sector warned that the use of bank cards for sports activities betting might shock some betting aficionados with surprising charges.

Improve in Money Advance Charges

The announcement got here from the Shopper Monetary Safety Bureau (CFPB) which launched a brand new report, warning about a rise within the so-called bank card money advance charges following sports activities betting legalization. The additional charges, steadily titled as “money advance” charges are relevant to sports activities betting transactions.

If a bank card firm helps inserting wagers with sportsbooks on credit score, it’s doubtless that such charges apply to every wager. Per the CFPB’s new report launched earlier this week, the widespread money advance charges are primarily based on the “better of $10 or 5%.” The report follows a assessment of bank card agreements by seven bank card firms that supported betting on credit score and cost money advance charges.

Sports activities betting is accessible in 38 states throughout the nation. Nonetheless, solely a number of states implement a ban on playing with bank cards with the checklist together with Iowa, Massachusetts, Tennessee and Rhode Island. Elsewhere, bettors can place wagers with their credit cards however until they need to be shocked by charges that can chunk into their winnings, they should assessment their bank card contracts.

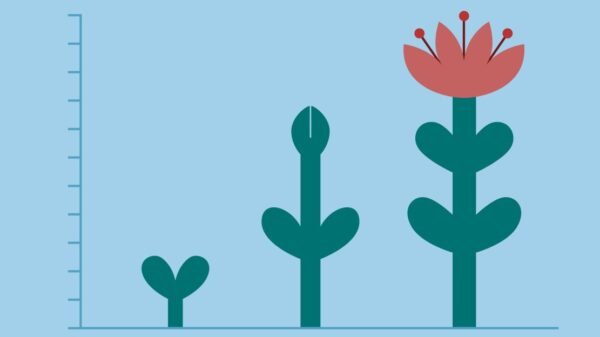

As soon as Betting Launches, Money Advance Charges Improve and Stay Greater than the Nationwide Common

Notably, CFPB’s new report pointed to knowledge evaluating the rise in money advance charges in states earlier than and after the legalization of sports activities wagering. This knowledge pointed to an fascinating development the place upon the preliminary launch of sports activities betting, a spike in money advance charges is explored and whereas the preliminary enhance settled down, the charges nonetheless remained excessive when in comparison with the remainder of the nation.

The report explains: “The month-to-month share of accounts charged a money advance price spiked in some states as soon as sports activities playing grew to become authorized. Whereas correlations between permitting wagers on sports activities and money advance charges don’t essentially present a causal relationship, an fascinating development emerges when accounts in Kansas, Missouri, and Ohio.”

A graph inside the new report reveals that Kansas recorded a notable enhance in money advance charges after launching authorized sports activities betting. The same however smaller in measurement enhance was recorded in Missouri, whereas the expansion of money advance charges in Ohio reached a degree nearer to the spike in Kansas. This development highlighted the attainable relationship between money advance charges and sports activities betting. In all three aforementioned states, as of 2024, the money advance charges remained greater than in the remainder of the nation, per CFPB’s report.