This week is filled with key financial occasions that might considerably affect the crypto market. These macroeconomic knowledge come as market individuals gear up for the run into the year-end vacation.

In the meantime, Bitcoin (BTC) continues to carry above the $100,000 mark, with merchants and traders anticipating additional upside within the supposed Christmas rally.

US Macroeconomic Knowledge That Might Affect Bitcoin Sentiment This Week

Crypto market individuals, merchants, and traders alike can be watching the next US financial knowledge this week for worth implications.

S&P Flash Companies and Manufacturing PMI Knowledge

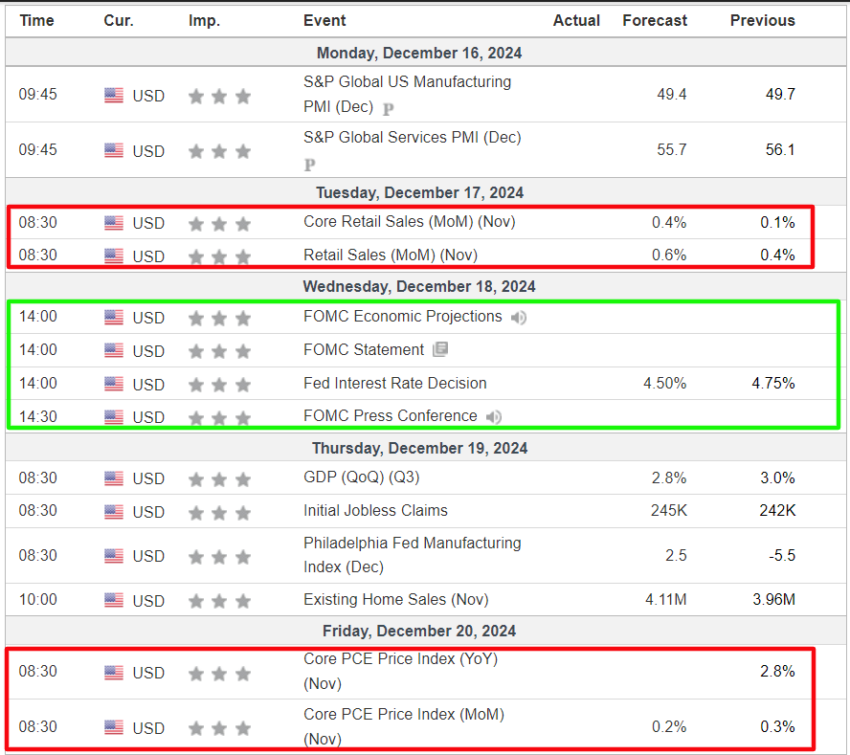

The week begins with the discharge of the S&P Flash Companies and Manufacturing Buying Managers’ Indices (PMI) on Monday. PMI knowledge, derived from month-to-month enterprise surveys, function key indicators of financial well being, usually used to foretell market developments and assess enterprise circumstances.

The companies PMI for November stood at 56.1, with December’s consensus forecast barely decrease at 55.3. In the meantime, the manufacturing PMI, which was 49.7 in November, is predicted to dip marginally to 49.6 in December. A PMI above 50 signifies financial enlargement, whereas a studying beneath 50 alerts contraction.

If the info reveals power within the companies and manufacturing sectors, it could bolster general financial confidence. This optimism might enhance investor urge for food for riskier belongings, together with cryptocurrencies. Nevertheless, economists stay cautious as issues concerning the broader financial outlook persist.

“The US Financial system is in full SHAMBLES proper now. We have now had an inverted yield curve and ISM Manufacturing PMI underneath 50 for nearly a yr now. The inversion in yield curves has predicted the final 7 recessions efficiently. Earlier than the COVID and 2008 Crash ISM Manufacturing PMI was underneath 50,” a preferred consumer on X shared.

Retail Gross sales Knowledge

One other US financial knowledge that may curiosity crypto market individuals this week is the retail gross sales knowledge. After the 0.4% studying in October, economists forecast a November studying of 0.6%. The retail gross sales knowledge will present insights into client spending patterns and general client confidence.

If retail gross sales are sturdy, indicating that buyers are spending extra, it might be seen as a optimistic signal for the economic system. This might result in elevated investor confidence in conventional monetary markets, which can spill over into the crypto market as effectively.

Retail gross sales knowledge can even affect inflation expectations. If retail gross sales are sturdy, it might sign growing demand and doubtlessly increased inflation down the road. Cryptocurrencies like Bitcoin are sometimes considered as a hedge towards inflation, so any indicators of rising inflation might drive traders towards cryptocurrencies.

“Sturdy gross sales=bullish markets, weak=risk-off,” standard analyst Mark Cullen said.

Fed Curiosity Price Determination (FOMC)

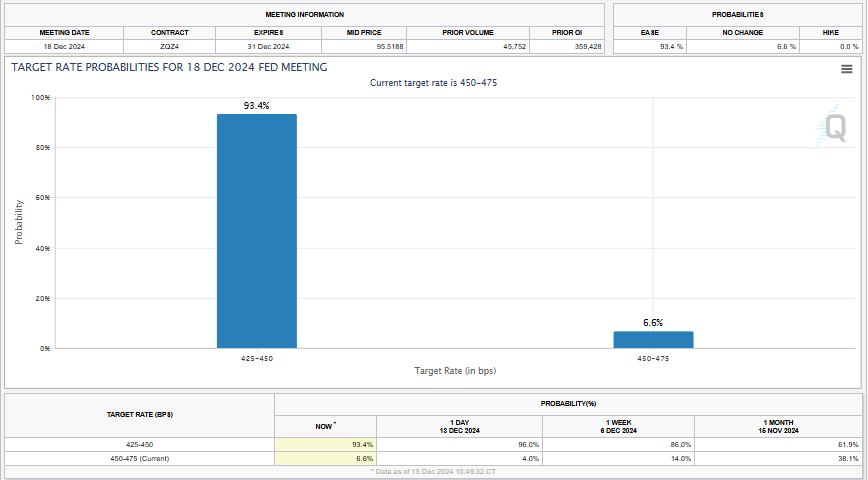

Nevertheless, the peak of this week’s US macroeconomic knowledge would be the Federal Reserve’s (Fed) interest rate decision on Wednesday. Crypto markets brace for market swings amid anticipation of whether or not the Fed will hike or minimize charges.

In response to the CME FedWatch Instrument, markets are anticipating a 25 foundation factors (0.25% bps) charge minimize on Wednesday. That is towards a 6.6% likelihood of the Fed reducing charges by 50 foundation factors (0.5%).

This implies an expectation that the Fed will undertake a extra cautious stance on reducing rates of interest subsequent yr amid indicators that the progress in reducing inflation towards the two% goal has stalled. In opposition to this backdrop, traders may also monitor the Fed’s dot plot to gauge if the median rate of interest projections present a hawkish shift within the Fed’s outlook.

Shortly after the FOMC, Fed chair Jerome Powell will maintain his press convention, marking one other fascinating look ahead to crypto market individuals.

“Markets are intently waiting for any indicators of future tightening or dovish feedback. A shock right here might set off vital strikes throughout the board, particularly in curiosity rate-sensitive sectors,” a preferred consumer on X (Twitter) remarked.

The US Shopper Value Index (CPI) and the Producer Value Index (PPI) launched final week strengthened expectations that the Fed will sluggish the tempo of its rate-cutting cycle subsequent yr. Particularly, CPI elevated once more, whereas Core CPI refused to lower. In the meantime, the unemployment charge is steadily growing.

Given this example, the FED is prone to proceed decreasing rates of interest by one other 0.25%. Nevertheless, this stance could also be primarily based on the hope that that is solely a short lived scenario and that inflation and the unemployment charge will proceed to lower within the coming time.

Q3 2024 GDP Knowledge

On Thursday, the US Bureau of Financial Evaluation (BEA) will launch the second revision of third quarter (Q3) GDP knowledge. This knowledge will provide perception into the well being of the economic system as we method the top of the yr.

Of observe is that this is among the major gauges of the US economic system’s well being, with a median forecast of two.9% after the earlier 2.8%. Which means the US GDP grew at an annual charge of two.8% in Q3 2024, and markets will watch to see whether or not the development continues.

PCE Inflation Knowledge

To shut out the week, the November Private Consumption Expenditure (PCE) inflation knowledge can be launched on Friday. It’s a measure of client spending and consists of all items and companies purchased by US households. This makes it a vital measure for the Fed, which means any surprises right here might have a direct impression on the Fed’s future coverage choices and market sentiment.

In response to The Kobeissi Letter, a preferred commentary on the worldwide capital markets, the one-month annualized core PCE inflation is now at 3.5%+ as merchants await November’s knowledge on the finish of the week. In the meantime, the one-month, three-month, and six-month annualized core PCE inflation are all again on the rise right here.

Equally, the one-month annualized Supercore PCE inflation is now nearing a whopping 5%. Then again, headline Supercore PCE inflation is above 3.5% and again on the rise. Taken collectively, these knowledge present that buyers are again underneath strain of extreme inflation in lots of classes.

Based mostly on the above, the week could also be wild, with potential heightened volatility round these occasions. On the time of writing, BTC was buying and selling for $104,991, a modest 2% rise since Monday’s session opened.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.