Additionally: An Ethereum dev’s defection to Solana; Polygon’s large proving-system flex; crypto’s most influential

Dec 11, 2024, 7:45 p.m. UTC

Welcome to The Protocol, CoinDesk’s weekly wrap-up of crucial tales in cryptocurrency tech improvement. I am Marc Hochstein, CoinDesk’s deputy editor-in-chief for options, opinion and requirements.

On this problem:

- What does Google’s quantum computing chip imply for Bitcoin?

- Dev’s defection highlights Ethereum’s rising Solana drawback

- OrdinalsBot inscribes largest-ever file on Bitcoin blockchain

- Polygon touts velocity of Plonky3 proving system

- Crypto’s most influential techies of 2024

Community Information

NEED FOR SPEED: Polygon Labs claims its latest proving system, Plonky3, is the quickest in the marketplace. (Vitalik Buterin, Ethereum’s creator, apparently agrees.) A proving system is on the core of zero-knowledge rollups, and a vital element for transactions that depend on cryptographic safety. It’s the essential piece of expertise that creates proofs that summarize off-chain transactions, that are then despatched again to a base blockchain (on this case, Ethereum). “If a zkVM is a automotive, you would take a look at the proving system as being the engine, so Plonky3 is form of what makes the whole lot work,” Brendan Farmer, a co-founder at Polygon, tells CoinDesk’s Margaux Nijkerk. The faster a proof is generated, the much less computing time that have to be paid for. “If we enhance velocity, then we’re enhancing prices,” Farmer stated. “And so what this does is it makes ZK rollup actually aggressive by way of prices.” In January 2022, Polygon launched its previous proving system, known as Plonky2, claiming then that it was the quickest one in the marketplace. Plonky3, the brand new and improved model that has extra flexibility, was released in July.

IN AWE OF THE SIZE OF THIS LAD: Bitcoin inscriptions venture OrdinalsBot minted what it says is the biggest file ever on the oldest and most beneficial blockchain: the final in a group of 1,500 “Pizza Ninjas.” It is a part of a phenomenon within the Bitcoin improvement neighborhood referred to as “4 meggers,” that are recordsdata that take up a complete block on the community. They’re known as 4 meggers as a result of they’re nearly 4 megabytes (MB) large (the utmost measurement of every block of transactions on Bitcoin). Ordinal collectors think about them helpful resulting from their visibility on the blockchain. “There’s extra than simply bragging rights behind eager to have the biggest file on Bitcoin,” stated Toby Lewis, co-founder of OrdinalsBot. “4 meggers will probably be on the Bitcoin blockchain ceaselessly they usually already maintain vital market worth.” Bitcoin inscriptions, much like non-fungible tokens (NFTs) on Ethereum, have been made attainable by the Ordinals protocol. It permits knowledge to be “inscribed” onto particular person satoshis, or “sats” (the smallest unit of BTC at 1/100,000,000 of a full bitcoin), making every one distinctive and probably helpful. Read more.

JUMPING SHIP: Ethereum’s place close to the highest of the crypto market is unquestioned from the attitude of market cap. Beneath the floor – on the product, developer and decision-making ranges – the unique sensible contracts platform continues to take a beating from Solana, one in all its closest rivals. Ethereum and its many closely-linked networks are nonetheless crucial, influential, and largest platforms for decentralized finance. That lead is starting to erode, nonetheless, with many newcomers to crypto selecting Solana’s velocity and low charges. The dynamic was additional punctuated Monday with information that longtime Ethereum ecosystem developer Max Resnick was transferring into Solana’s orbit, abandoning his job on the developer studio Consensys. “There’s simply a lot extra chance and potential power in Solana,” Resnick stated in an interview with CoinDesk. He framed the choice as rooted in his personal profession path, however famous “frustration” with Ethereum’s incapability to adapt contributed to the transfer. Ethereum lacks a streamlined course of for making fast adjustments. Some see that as some extent of energy for a decentralized community, whereas others, like Resnick, see it as a hindrance for long-term success. Read more

MOST INFLUENTIAL: This week, for the tenth time, CoinDesk has chosen the individuals who outlined the 12 months in crypto: Our Most Influential list. (Right here was the first edition in 2015.) Most Influential highlights private achievements within the final calendar 12 months. Persons are chosen for his or her initiatives, concepts, management, character, or notoriety. There’s a high 10 of essentially the most Most Influential – folks we really feel had outsize affect or led crucial initiatives. Then, we profile one other 40 individuals who have been solely rather less influential. (Sure outstanding folks in crypto – Vitalik Buterin, say – would naturally be Most Influential yearly. However we select to not function the identical names every time.) Among the many tech luminaries we highlighted on this 12 months’s collection have been Solana’s Lilly Liu, Optimism’s Jin Yang, EigenLayer’s Sreeram Kannan, BitVM’s Robin Linus, Rootstock’s Sergio Lerner, TON’s Steve Yun, NEAR’s IIlia Polosukhin, Akash Network’s Greg Osuri; Bitcoin’s Taproot Wizards founders … and naturally, Satoshi Nakamoto, whose secret id stays a parlor-game matter in spite of everything these years. (Writing that final piece was downright cathartic for me.) Discover all of the profiles here.

WHAT DOES GOOGLE’S QUANTUM COMPUTING CHIP MEAN FOR BITCOIN?

Google’s new quantum computing chip may imply bitcoin (BTC) is completed.

That was the sentiment for some on Monday because the web large unveiled Willow, a quantum supercomputer that may carry out sure computational duties in simply 5 minutes that may take classical supercomputers an astronomical period of time—particularly, 10 septillion years (or one adopted by 24 zeroes; a trillion trillion).

10,000,000,000,000,000,000,000,000. Such an period of time is bigger than the existence of your entire universe at 13.8 billion years.

In superficial idea, such a strong laptop may imply no passwords are protected, encrypted messages are intercepted, nuclear weapons codes are came upon, and nearly something may be unlocked by brute-forcing combos of numbers and letters.

But it surely isn’t all doom and gloom but.

Whereas quantum computing does certainly pose vital threats to present safety programs, it isn’t a grasp key to the universe, at the least not proper now. And there’s no looming risk to Bitcoin, both.

Quantum computing leverages the ideas of quantum mechanics, utilizing quantum bits or qubits as an alternative of conventional bits. Not like bits which signify both a 0 or 1, qubits can signify each 0 and 1 concurrently resulting from quantum phenomena like superposition and entanglement. This enables quantum computer systems to carry out a number of calculations directly, probably fixing issues which are presently intractable for classical computer systems. Willow makes use of 105 qubits and demonstrates an exponential error discount because the variety of qubits will increase. It is a vital step in direction of constructing a sensible, large-scale quantum laptop, stated Google CEO Sundar Pichai.

Bitcoin makes use of algorithms like SHA-256 for mining and ECDSA for signatures, which may be susceptible to quantum decryption. And the quick reply is that quantum computer systems, even superior ones like Google’s Willow, don’t possess the dimensions or error correction capabilities wanted to right away decrypt extensively used encryption strategies like RSA, ECC (utilized in Bitcoin transactions), or AES (utilized in securing knowledge).

If quantum computer systems like Willow attain a scale the place they will simply consider giant numbers, they may probably break these encryption schemes, compromising pockets safety and transaction integrity. That may require quantum computer systems with thousands and thousands and even billions of “qubits” with extraordinarily low error charges, far past the present expertise.

“Google claims to have demonstrated ‘under threshold’ error correcting capabilities with their newest quantum chip,” stated Chris Osborn, founder at Solana ecosystem venture Dialect, in a submit on X (previously Twitter). “‘Under threshold’ is {industry} jargon for turning bodily qubits, that are noisy, s*itty quantum bits which are principally ineffective, into logical qubits, that are multi-qubit abstractions that appropriate for errors & allow you to truly carry out actual computation.” he added.

It takes roughly 5,000 logical qubits “to run Shor’s algorithm to interrupt encryption. In different phrases, thousands and thousands of bodily qubits are wanted to interrupt encryption. Google’s chip at the moment: 105 bodily qubits,” Osborn famous.

Till then, cryptocurrencies (and different sectors) have time to develop quantum-resistant algorithms.

CLICK HERE FOR THE FULL ARTICLE BY COINDESK’S SHAURYA MALWA

Cash Middle

Gap within the pockets

Offers and grants

- Binance Partners With Circle to Push USDC Stablecoin Adoption Across the Globe

- Stablecoin Trading Startup Perena Tries Its Luck on Solana

Glad perp-day

Regulatory and coverage

Calendar

- Dec. 4-5: India Blockchain Week, Bangalore

- Dec. 5-6: Emergence, Prague

- Dec. 9-12: Abu Dhabi Finance Week

- Dec. 11-12: AI Summit NYC

- Dec. 11-14: Taipei Blockchain Week

- Jan 9-12, 2025: CES, Las Vegas

- Jan. 15-19: World Economic Forum, Davos, Switzerland

- January 21-25: WAGMI conference, Miami.

- Jan. 24-25: Adopting Bitcoin, Cape City, South Africa.

- Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

- Feb. 1-6: Satoshi Roundtable, Dubai

- Feb. 19-20, 2025: ConsensusHK, Hong Kong.

- Feb. 23-24: NFT Paris

- Feb 23-March 2: ETHDenver

- Might 14-16: Consensus, Toronto.

- March 18-19: Digital Asset Summit, London

- Might 27-29: Bitcoin 2025, Las Vegas.

Marc Hochstein

As Deputy Editor-in-Chief for Options, Opinion, Ethics and Requirements, Marc oversees CoinDesk’s long-form content material, units editorial insurance policies and acts because the ombudsman for our industry-leading newsroom. He’s additionally spearheading our nascent protection of prediction markets and helps compile The Node, our each day electronic mail publication rounding up the largest tales in crypto.

From November 2022 to June 2024 Marc was the Government Editor of Consensus, CoinDesk’s flagship annual occasion. He joined CoinDesk in 2017 as a managing editor and has steadily added tasks over time.

Marc is a veteran journalist with greater than 25 years’ expertise, together with 17 years on the commerce publication American Banker, the final three as editor-in-chief, the place he was chargeable for a few of the earliest mainstream information protection of cryptocurrency and blockchain expertise.

DISCLOSURE: Marc holds BTC above CoinDesk’s disclosure threshold of $1,000; marginal quantities of ETH, SOL, XMR, ZEC, MATIC and EGIRL; an Urbit planet (~fodrex-malmev); two ENS domains (MarcHochstein.eth and MarcusHNYC.eth); and NFTs from the Oekaki (pictured), Lil Skribblers, SSRWives, and Gwar collections.

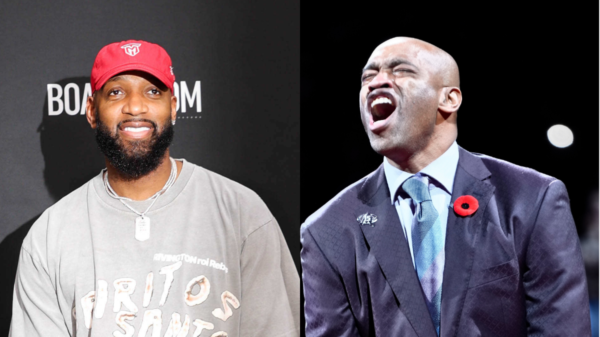

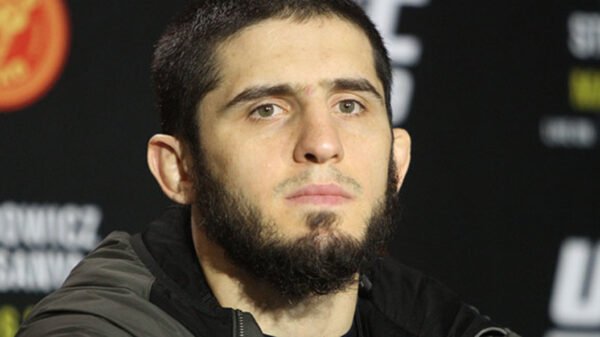

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-600x337.jpg)

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-100x100.jpg)