Notable value declines included the communication index (-1.0%), indicating deflation in choose sectors. General, November marked the primary time in 5 months that inflation accelerated, signaling persistent pricing challenges.

What Does This Imply for Federal Reserve Coverage?

The Federal Reserve’s decision-making is underneath scrutiny as inflation stays above its 2% goal. Markets largely count on the central financial institution to cut back its benchmark rate of interest by 0.25% on the December 18 assembly. Nevertheless, some Fed officers have expressed considerations in regards to the resilience of inflation and recommended a cautious method to future price cuts. Ought to the Fed proceed, it would have trimmed charges by a full share level since September.

Regardless of price cuts, inflation’s stickiness in classes like shelter (+4.7% yearly) and motorcar insurance coverage (+12.7% yearly) may restrict the central financial institution’s flexibility in easing financial coverage additional in early 2025.

What Lies Forward for Markets?

The inflation report underscores the probability of a blended market outlook. The anticipated price reduce could provide reduction for fairness and bond markets, however persistent inflation in core classes may mood optimism. With shelter and meals costs nonetheless rising, shopper spending energy could face constraints. Vitality costs, which have moderated on an annual foundation, may present some respite if present stabilization traits proceed.

Market Forecast: Inflation’s trajectory suggests a cautiously bearish short-term outlook for bonds and a mixed-to-bullish state of affairs for equities, contingent on the Federal Reserve’s actions subsequent week. Merchants ought to monitor Fed commentary intently for indicators of coverage shifts into 2025.

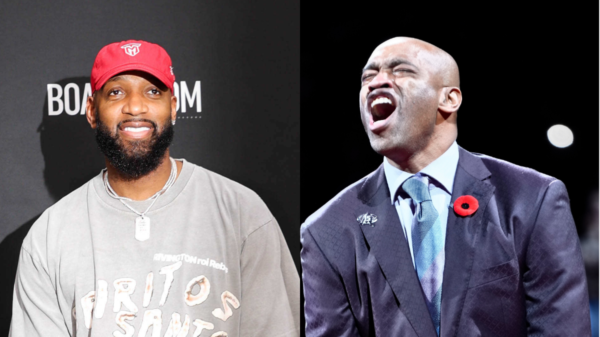

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-600x337.jpg)

![Aljamain Sterling: I feel Dana White ‘would possibly dislike [Movsar Evloev] greater than me … that’s a very good factor’](https://news247planet.com/wp-content/uploads/2024/12/1083986-aljamain-sterling-i-feel-dana-white-would-possibly-dislike-movsar-evloev-greater-than-me-t675261b32df2e-100x100.jpg)