-

Consensus for headline inflation year-over-year is predicted to extend by 0.2% to 2.6% — the primary year-on-year improve since March 2024.

-

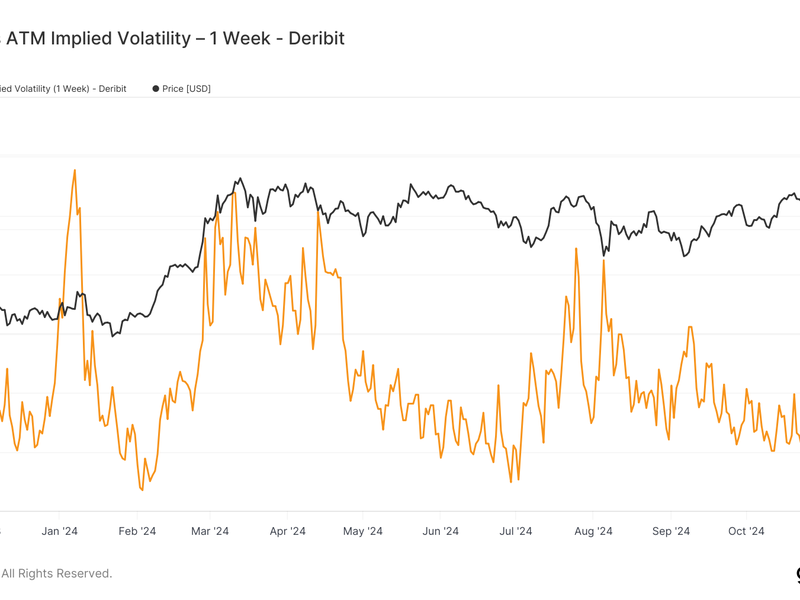

Bitcoin’s 30-day implied volatility spiked to as excessive as 90% previous week, and will see additional volatility when U.S. inflation information is introduced.

01:01

Bitcoin Breaks $64K Whereas Gold Soars

00:56

ETH/BTC Ratio Slid to Lowest Since April 2021

00:57

Is Bitcoin Dropping Its Bullish Momentum?

The U.S. inflation report set to be launched on Wednesday has the potential to fire up bitcoin (BTC) worth volatility, ending the 48-hour interval of calm.

Its been a whirlwind week for cryptocurrencies, with Donald Trump successful the united statespresidential election on Nov. 6. Consequently, the full cryptocurrency market jumped from $2.2 trillion to $3 trillion again all the way down to roughly $2.8 trillion, in keeping with TradingView.

Whereas bitcoin (BTC), the biggest cryptocurrency by market capitalization, touched $90,000 on Nov. 12 simply earlier than U.S. fairness markets closed.

U.S. inflation information just isn’t squashed

Per FXStreet, the U.S. shopper worth index (CPI) due at 8:30 ET, is predicted to indicate that the price of residing elevated 2.6% year-on-year in October, having risen 2.4% within the previous month. This may be the primary year-on-year improve since March.

The difficulty of embedded inflation just isn’t from headline however from core inflation, year-over-year. Early this yr, we noticed core come down from 3.9% to three.2%. Nevertheless, it turned larger in September to three.3%, presenting a problem to the Fed.

The priority of inflation not being slayed will be proven within the U.S. yields, which have solely soared because the Federal Reserve began the rate-cutting cycle with a 50bps charge lower, adopted by an extra 25bps charge lower. Because the first charge lower on Sep. 16, the U.S. 10Y has jumped from 3.6% to 4.4%. With the U.S. 3-month treasury yield buying and selling at 4.6%, which follows the efficient federal funds charge, it is suggesting that not more than 25bps of charge cuts will happen over the following three months, as the present goal charge is 450 – 475.

So, with a spike in implied volatility and an anticipated improve in headline inflation YoY, might bitcoin see a dramatic worth swing later immediately?

Implied volatility has risen

Implied volatility for choices contracts expiring one week from immediately has spiked from 40% to as excessive as 90% on account of bitcoin’s climb to $90,000, a rise of greater than $20,000 since Nov. 6. Glassnode defines implied volatility because the market’s expectation of volatility. Viewing At-The-Cash (ATM) IV over time provides a normalized view of volatility expectations, which is able to usually rise and fall with realized volatility and market sentiment.

How has bitcoin fared on earlier U.S. CPI releases?

Inflation information releases introduced draw back volatility to bitcoin within the first quarter. It carried out negatively as inflation remained virtually double the inflation goal. For instance, bitcoin fell as a lot as 7.5% on Jan. 12 when the U.S. reported a warmer inflation determine for December.

Nevertheless, because the yr progressed and headline inflation YoY continued to sluggish, this turned extra of a bullish occasion for bitcoin, finally registering a 6.7% worth improve on Jul. 15 for example.

As inflation slowed, the market turned extra environment friendly and produced three consecutive 0-1% worth actions. Now, inflation is predicted to rebound once more.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/KIAXVK5KHBDWFMFWYZ3COBFYSI.png)

Edited by Oliver Knight.

Disclosure

Please word that our

and

do not sell my personal information

have been up to date

.

CoinDesk is an

media outlet that covers the cryptocurrency business. Its journalists abide by a strict set of

CoinDesk has adopted a set of rules geared toward making certain the integrity, editorial independence and freedom from bias of its publications. CoinDesk is a part of the Bullish group, which owns and invests in digital asset companies and digital property. CoinDesk staff, together with journalists, might obtain Bullish group equity-based compensation. Bullish was incubated by know-how investor Block.one.

Because the senior analyst at CoinDesk, James focuses on Bitcoin and the macro atmosphere. His earlier function as a analysis analyst at Swiss hedge fund Saidler & Co. launched him to on-chain analytics. He screens ETFs, spot and futures volumes, and flows to grasp Bitcoin.

:format(jpg)/author-service-images-prod-us-east-1.publishing.aws.arc.pub/coindesk/7fe88428-ae49-4453-ab19-5cfbf125689b.png)