The strongest market agitator within the first half (H1) of 2025 shouldn’t be prone to be both U.S. unemployment or inflation brought on by financial or fiscal coverage. Based mostly on the newest readings, inflation is persistently lowering, reacting as anticipated to the Federal Reserve’s rate of interest hike marketing campaign that despatched mortgage charges greater than they’ve been for the reason that begin of the millennia. Nevertheless, this period is ending, resulting in an anticipated enhance in mortgage lending and an uptick in RMBS issuance, particularly in H1 2025.

What’s the catalyst that will trigger all of it to collapse? Not mismanagement of financial or fiscal coverage on behalf of the U.S. authorities, however somewhat international commerce disruptions. World occasions destabilizing the world’s oil provide might kick inflation again into excessive gear and make the FOMC’s QE and QT campaigns fail. Any provide chain disruption to essential commerce routes worldwide might trigger the identical points with manufactured items and expertise worth will increase as a consequence of an absence of provide from international producers. A current instance is these seen lately on the US East and Gulf coasts because of the short-lived Longshoreman’s union strike.

Non-QM will virtually actually develop and thrive in a decrease charge setting the place the borrower’s price of proudly owning a house is decrease because of the materials discount in lending charges brought on by the Federal Reserve’s current rate of interest cuts.

The TAM, or whole addressable marketplace for non-QM lenders, primarily consists of small—or medium-sized enterprise house owners in america. In line with information from the St. Louis Fed, new enterprise functions have exploded for the reason that COVID-19 pandemic in 2020, roughly doubling and remaining elevated ever since.

As long as many Individuals proceed to go impartial and begin their very own small companies somewhat than work for large multi-national conglomerates, non-QM lenders may have sturdy product demand, and non-QM RMBS issuance will stay elevated. Residence costs are anticipated to stay steady on common due primarily to the basics (excessive demand and low provide). Nonetheless, we’re already observing weak spot in metro areas like Austin, Texas, the place fundamentals don’t assist excessive real estate costs. With housing inventories up over 30% 12 months over 12 months and never sufficient demand to soak up the availability, Austin has seen dwelling worth retracement of about 19% from 2022 highs (~5% decrease in home values in the last year).

Collateral composition is about to turn out to be exceedingly essential! Shopper monetary circumstances within the U.S. have deteriorated, with most Individuals having burnt by means of their pandemic financial savings and private financial savings charges hitting near GFC-era lows.

The issuers whose underwriting and valuation procedures are extra correct/conservative will win the differentiation battle and turn out to be generally known as top-tier issuers. Additionally, with the 50 foundation level September charge lower and extra cuts anticipated in December and into 2025, there’s an expectation for borrower prepayment charges to extend. Prepayments may cause appreciable ache for buyers who, initially anticipating the period of an asset to be 2 or 4 years of engaging coupon funds, are actually solely going to obtain half as many coupon funds as a consequence of this enhance in prepays. Offers with greater non-owner-occupied collateral concentrations will turn out to be extra engaging as pre-payment penalties on funding property loans de-incentivize debtors from prepaying their mortgages.

Macro and volatility threat are all the time part of the equation for issuers. Skilled issuers have seen multiple market cycle by now and know that one of the best ways to manage these dangers as a programmatic issuer (along with the normal charge hedges which can be commonplace at any subtle MBS issuer) is by utilizing the identical precept that retail buyers use of their portfolios. Issuing a number of securitizations all year long permits issuers to successfully common greenback prices into capital markets. Most offers are worthwhile, however when macro volatility strikes, it could knock a deal off beam. That securitization’s poor returns can then be averaged out with different extra worthwhile offers to offer buyers with engaging returns.

Insurance coverage demand for non-QM RMBS resulted from the convergence of multiple occasion coinciding.

Rates of interest elevated quickly, rising yields on non-QM RMBS, and traditional mortgage originations decreased considerably.

What do you do when your regular “favourite” asset has no significant provide? Discover an alternate! For insurance coverage corporations, that is the non-QM house. They’ve been closely buying non-QM belongings and present little signal of slowing down. Hedge funds have all the time paid consideration to the non-QM house, however now the hedge funds (and their much more essential patrons) are getting concerned immediately. Certainly, Atlas Service provider Capital, A&D Mortgage and Imperial Fund lately introduced a three way partnership partnership. The enterprise, utilizing each inside and third-party capital, will fund the acquisition and securitization of non-QM mortgage loans originated by A&D. Different distinguished examples embody the Ares-Amwest deal and the CPPIB – Redwood Belief deal, which present how hedge and pension funds are additionally starting to note the chance within the burgeoning non-agency, non-QM mortgage origination and securitization house.

Victor Kuznetsov is the Managing Director and Co-Founding father of Imperial Fund

This column doesn’t essentially replicate the opinion of HousingWire’s editorial division and its house owners.

To contact the editor accountable for this piece: [email protected]

NFL

Now that rates of interest are happening, right here’s what to anticipate for the remainder of the 12 months

The strongest market agitator in the first half (H1) of 2025 is not likely to be either U.S. unemployment or inflation caused by monetary or fiscal policy. Based on the latest readings, inflation is consistently decreasing, reacting as expected to the Federal Reserve’s interest rate hike campaign that sent mortgage rates higher than they have

You May Also Like

Baseball

The ground in the visiting clubhouse at Yankee Stadium had barely started drying up before the hot stove got cooking. Free agency is here,...

AEW

Mike Chiari @@mikechiari Featured Columnist IV September 8, 2024 AEW In the latest chapter of one of AEW's most heated rivalries, "Hangman" Adam Page...

NBA

Scott Polacek @@ScottPolacek Featured Columnist IV October 28, 2024 Mitchell Leff/Getty Images Joel Embiid hasn't played a game yet this season, but he is...

Boxing

Teofimo Lopez seems to have struck up a good relationship with Canelo Alvarez . Recently, in a media interview ahead of the Edgar Berlanga...

Boxing

Over the past few months and after recently dipping his toes in with ‘King’ Callum Walsh, UFC CEO Dana White has repeatedly teased that...

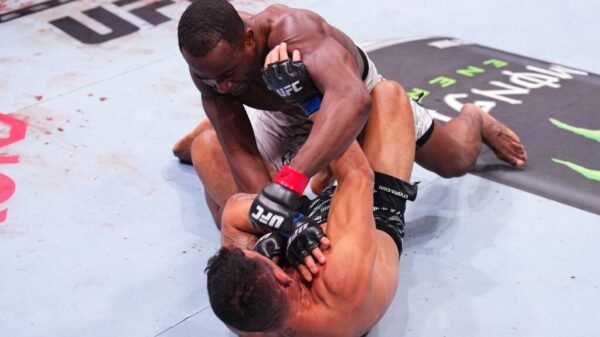

UFC

October 30, 2024 1:30 pm ET Ailin Perez has her first fight booked since entering the official UFC rankings. The rising women’s bantamweight contender...

WWE

Parent company of WWE and UFC is buying Professional Bull Riders, On Location, and IMG in a $3.25 billion deal By The Associated Press...

NFL

Former NFL player and current analyst Ryan Clark sparked controversy on social media after he wore a Bill Belichick mask on the CW’s "Inside...

WWE

WWE SmackDown Results: Winners, Live Grades, Reaction, More Before Bash in Berlin 0 of 5 SmackDown. WWE Welcome to Bleacher Report's live coverage of...

NBA

Scott Polacek @@ScottPolacek Featured Columnist IV October 24, 2024 Issac Baldizon/NBAE via Getty Images The good news for the Miami Heat is things can...

Boxing

Gabriel Silva, son of UFC legend Anderson Silva, returns to the boxing ring Saturday to challenge Anthony Taylor for the Misfits light heavyweight title...

Boxing

Please enable JS and disable any ad blocker

Motorsports

The streak of good news for Dale Earnhardt Jr. fans continues as the veteran driver bags another achievement. This week the Dale Jr. fans...